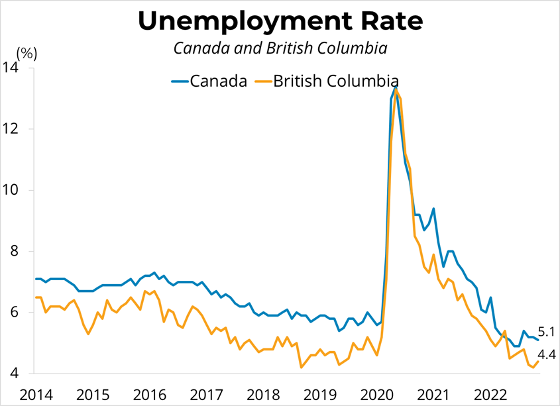

The Bank of Canada raised its overnight policy rate by 50 basis points, bringing it to 4.25 per cent, its highest level since 2008. In the statement accompanying the decision, the Bank noted that the Canadian economy continues to operate in excess demand with tight labour markets and as a result inflation remains elevated. There is increasing evidence that tighter monetary policy is restraining the domestic economy, with household spending declining in the third quarter while interest-rate sensitive sectors like housing continue to sharply contract. The Bank continues to expect economic growth to stall through the end of 2022 and into the first half of 2023. Inflation is expected to ease over the next year, falling to 3 per cent in 2023 and returning to the 2 per cent inflation target in 2024. The next rate announcement is on January 25th, 2023.

After a year of aggressive tightening that now appears to be at or very close to an end, the Bank may reverse course in the second half of 2023 as the economy slows significantly or even tips into recession. Crucially, any loosening of monetary policy will only occur if we see a sustained decline in inflation. Given weakening economic growth, falling gasoline and other commodity prices, and fading effects from pandemic driven supply chain problems, we could see a significant downward trajectory for inflation in 2023, which would provide the Bank with the necessary support to begin lowering its policy rate.

Link: https://www.bankofcanada.ca/2022/12/fad-press-release-2022-12-07/

For more information, please contact: Gino Pezzani.

If you're thinking about giving gifts to your employees during the December holidays, that's a good idea, but approach it with caution. Here are some basic pointers:

If you're thinking about giving gifts to your employees during the December holidays, that's a good idea, but approach it with caution. Here are some basic pointers: