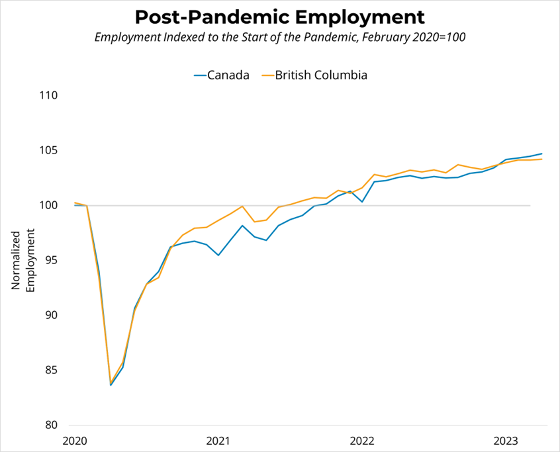

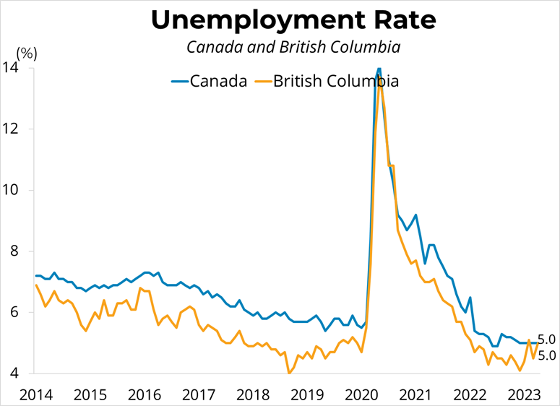

Canadian employment rose slightly to 20.13 million in April, up by 41,400 (0.2 per cent). The Canadian unemployment rate held steady at 5 per cent, unchanged since December. Employment gains were concentrated in wholesale and retail trade (+24,000); transportation and warehousing (+17,000); and information, culture and recreation (+16,000). Average hourly wages were up 5.2 per cent from April of last year.

Employment in BC was little changed in April, rising 0.1 per cent to 2.78 million, while declining by 0.1 per cent in Metro Vancouver to 1.564 million. The unemployment rate rose to 5 per cent in BC and to 5.4 per cent in Metro Vancouver. The rise was driven both by a rise in labour force participation, but also an increase in the number of unemployed workers.

Link: https://mailchi.mp/bcrea/canadian-employment-april-2023-may-5th-2023

For more information, please contact: Gino Pezzani.

May Day, May 1: A celebration of spring and workers' rights, observed in many countries worldwide.

May Day, May 1: A celebration of spring and workers' rights, observed in many countries worldwide.

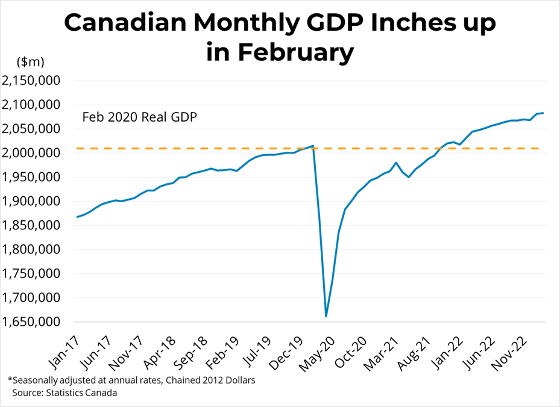

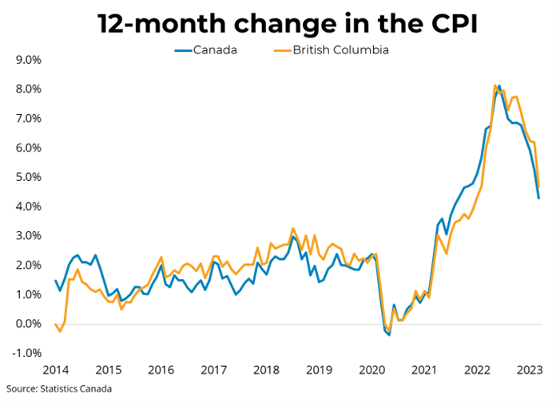

The Bank of Canada maintained its overnight rate at 4.5 per cent this morning. In the statement accompanying the decision the Bank noted that demand in Canada still exceeds supply and labour markets remain tight and that first quarter economic growth looks stronger than expected. However, the bank expects consumption growth to slow this year as households renew mortgages at higher rates and growth in exports and investment will decline as the US economy slows substantially in coming months. On inflation, the Bank expects headline CPI inflation to fall to 3 per cent in the middle of this year before declining gradually to 2 per cent by the end of 2024. However, the Bank warned getting inflation back to 2 per cent will be challenging given still high inflation expectations, elevated service sector prices and strong wage growth.

The Bank of Canada maintained its overnight rate at 4.5 per cent this morning. In the statement accompanying the decision the Bank noted that demand in Canada still exceeds supply and labour markets remain tight and that first quarter economic growth looks stronger than expected. However, the bank expects consumption growth to slow this year as households renew mortgages at higher rates and growth in exports and investment will decline as the US economy slows substantially in coming months. On inflation, the Bank expects headline CPI inflation to fall to 3 per cent in the middle of this year before declining gradually to 2 per cent by the end of 2024. However, the Bank warned getting inflation back to 2 per cent will be challenging given still high inflation expectations, elevated service sector prices and strong wage growth.

Link:

Link: