To view the BCREA Housing Forecast PDF, click here.

BCREA 2023 Fourth Quarter Housing Forecast

Vancouver, BC – October, 2023. The British Columbia Real Estate Association (BCREA) released its 2023 Fourth Quarter Housing Forecast today.

Multiple Listing Service® (MLS®) residential sales in BC are forecast to decline 4.8 per cent to 76,700 units this year. In 2024, MLS® residential sales are forecast to post a modest rebound, rising 4.8 per cent to 80,375 units.

"Activity in the BC housing market has mirrored movements by the Bank of Canada over the past two years,“ said Brendon Ogmundson, Chief Economist. “As such, there is little reason to believe that sales will meaningfully detach from the anchor that is monetary policy over the next year. Thankfully, it appears that the Bank is at, or at least very near, the end of its tightening cycle and may begin lowering its policy rate late next year.”

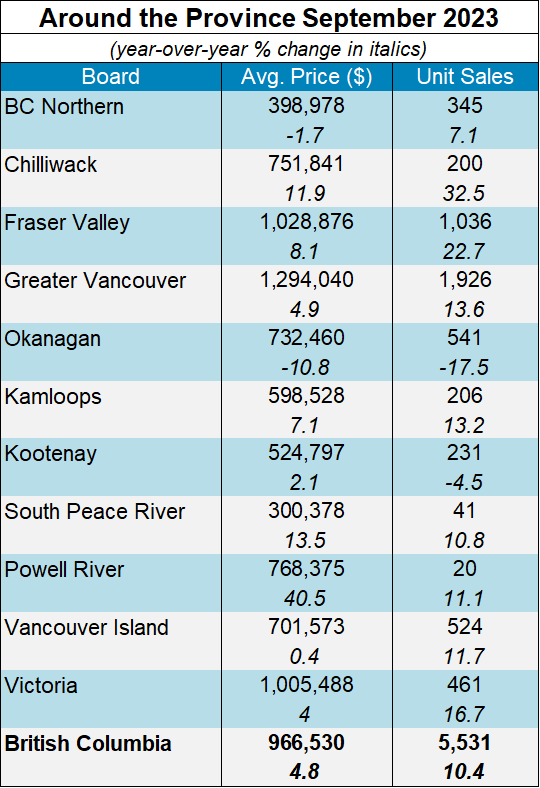

After trending down for most of the year, new listings activity has normalized in the second half of 2023, which, combined with slowing sales, has led to a modest uptick in total inventory. Still, at just over 30,000 listings, the supply of homes for sale falls considerably short of the roughly 45,000 active listings that are historically consistent with a healthy, balanced market. Prices saw a significant increase in the first half of the year, but that surge in prices has since given way to a flattening trend as market conditions balance out, albeit at a low level of market activity. We expect a 1.9 per cent decrease in annual prices for 2023 compared to 2022, with a slight uptick expected in 2024, driven by a projected recovery in the latter half of the year.

For more information, please contact: Gino Pezzani.

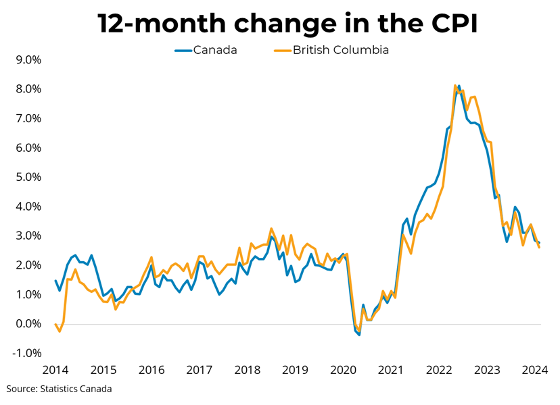

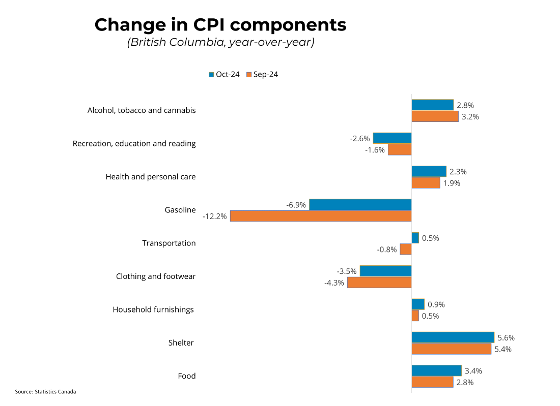

The Bank ofCanada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that there is growing evidence that higher interest rates are dampening economic activity, and it expects growth to be weak through 2024. On inflation, the Bank sees little downward momentum in its preferred measures of core inflation and expects inflation to average 3.5 per cent until the middle of next year before falling back to its 2 per cent target in 2025. Notably, the Bank stated that it is concerned that price stability is slow and inflationary risks have increased. As such, it is prepared to still raise its policy rate further if needed.

The Bank ofCanada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that there is growing evidence that higher interest rates are dampening economic activity, and it expects growth to be weak through 2024. On inflation, the Bank sees little downward momentum in its preferred measures of core inflation and expects inflation to average 3.5 per cent until the middle of next year before falling back to its 2 per cent target in 2025. Notably, the Bank stated that it is concerned that price stability is slow and inflationary risks have increased. As such, it is prepared to still raise its policy rate further if needed.