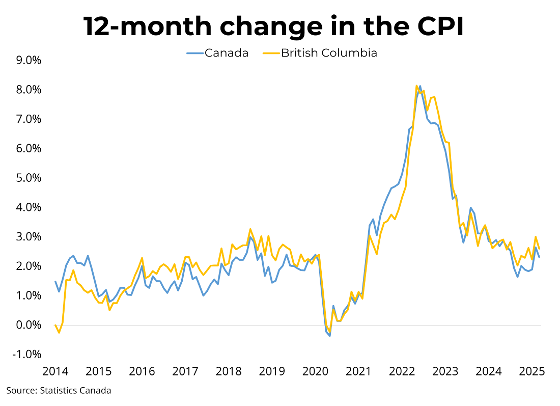

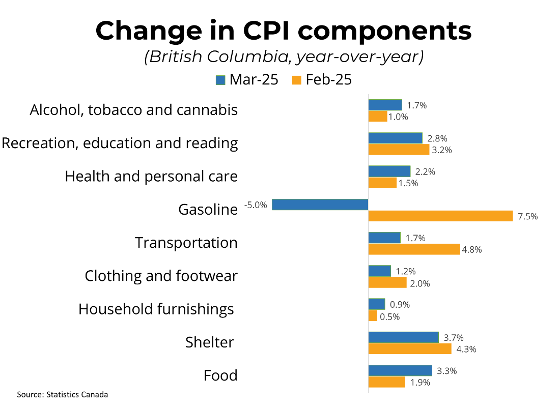

Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.3 per cent on a year-over-year basis in March, down from a 2.6 per cent increase in February. Month-over-month, on a seasonally adjusted basis, the CPI was unchanged in March. The overall slowdown in headline CPI is largely driven by lower gasoline prices, with the CPI ex-gasoline rising by 2.5 per cent in March. Shelter price growth continues to cool, as mortgage interest costs were up 7.9 per cent, marking the nineteenth consecutive month of deceleration. Similarly, rent was up 5.1 per cent year-over-year in March, down from 5.8 per cent in February. In BC, consumer prices rose 2.6 per cent year-over-year, down from 3.0 per cent in February. The Bank of Canada's preferred measures of median and trimmed inflation, which strip out volatile components, are at 2.9 per cent and 2.8 per cent year-over-year, respectively.

After a sharp uptick in February, March's CPI report saw headline inflation moderate towards the neutral range of 2.0 per cent. However, the Bank's core measures of inflation continue to linger near the ceiling of their target range, suggesting some underlying upward pressure in prices. Nonetheless, markets remain uncertain about the Bank's decision on Wednesday as Canada braces for the inflationary impacts of tariffs. This report slightly favours the odds of a 25-point rate cut on Wednesday to pre-emptively brace the economy for the damage caused by tariffs.

https://mailchi.mp/bcrea/canadian-inflation-march-2025

For more information, please contact: Gino Pezzani.

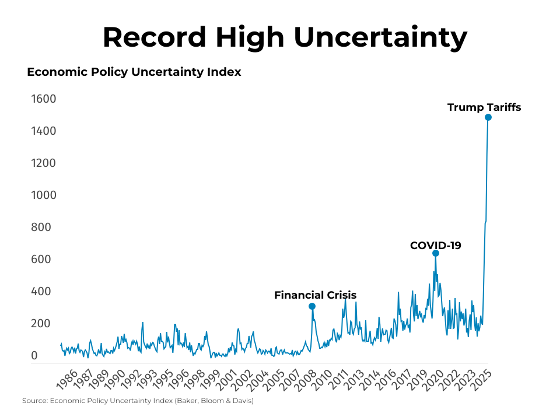

The Bank of Canada held its overnight policy rate at 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted that pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada. The Bank sees two potential scenarios for the Canadian economy, either high but limited tariffs that temporarily weaken growth or a protracted trade war that causes both a full recession and inflation to rise above 3 per cent. The Bank is already seeing signs of a slower economy due to the impact of uncertainty on consumer and business confidence, but expects tariff driven supply chain disruptions will put upward pressure on prices later this year. Perhaps most importantly, the Bank ended its statement with the following: "

The Bank of Canada held its overnight policy rate at 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted that pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada. The Bank sees two potential scenarios for the Canadian economy, either high but limited tariffs that temporarily weaken growth or a protracted trade war that causes both a full recession and inflation to rise above 3 per cent. The Bank is already seeing signs of a slower economy due to the impact of uncertainty on consumer and business confidence, but expects tariff driven supply chain disruptions will put upward pressure on prices later this year. Perhaps most importantly, the Bank ended its statement with the following: " Why Magnesium Matters

Why Magnesium Matters

Psychologist Dr. Richard Wiseman studied "lucky" and "unlucky" people for more than a decade. His research found that luck isn’t just fate; it’s a mindset. “Lucky” people tend to share four key traits:

Psychologist Dr. Richard Wiseman studied "lucky" and "unlucky" people for more than a decade. His research found that luck isn’t just fate; it’s a mindset. “Lucky” people tend to share four key traits:

April showers do more than bring May flowers; they tell a fascinating story. Each raindrop begins as a tiny water particle clinging to dust in the atmosphere and then growing until it falls to refresh our soil and

April showers do more than bring May flowers; they tell a fascinating story. Each raindrop begins as a tiny water particle clinging to dust in the atmosphere and then growing until it falls to refresh our soil and While spring is unfolding around us, I think about change — the kind that happens slowly, almost unnoticed, until one day you realize everything is different. The bare trees that stood silent through winter are now filled with life. The air is softer, the days are a little longer and the world is reawakening.

While spring is unfolding around us, I think about change — the kind that happens slowly, almost unnoticed, until one day you realize everything is different. The bare trees that stood silent through winter are now filled with life. The air is softer, the days are a little longer and the world is reawakening.