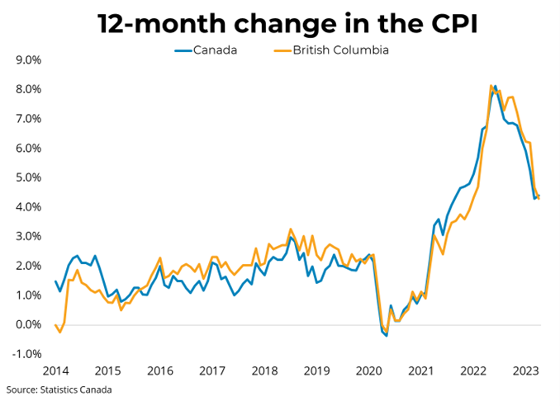

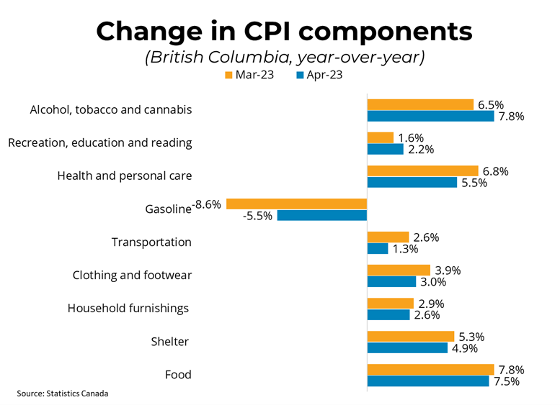

Canadian prices, as measured by the Consumer Price Index (CPI), rose 4.4 per cent on a year-over-year basis in April, a slight increase from the 4.3 per cent rate in March. Month over month, CPI rose 0.7 per cent, in large part due to higher gasoline prices, which jumped 6.3 per cent from last month. Shelter costs were up 4.9 per cent year over year, driven by much higher mortgage interest costs (up 28.5 per cent from last year) along with higher rents (up 6.1 per cent from April 2022). The homeowner's replacement cost, which tracks home prices, was up just 0.2 per cent year over year. Grocery prices were up 9.1 per cent year over year, down from 9.7 per cent last month. In BC, consumer prices rose 4.3 per cent year-over-year.

After rapid success in bringing down inflation since last fall, month-over-month CPI figures came in hotter than expected in April. Even after stripping out the large jump in gasoline prices, CPI rose 0.5 per cent from March, corresponding to a 6 per cent annualized rate, while food and shelter costs continue to rise faster than a 6 percent annualized rate. The Bank of Canada's measures of core inflation, which strip out volatile components, each fell on a year-over-year basis while rising month-over-month. Markets continue to expect the bank to hold its overnight rate steady at 4.5 per cent at their upcoming meeting on June 7th. However, in the context of a still strong labour market and the early signs of a rebound in the housing market, these CPI figures suggest that the Bank of Canada is still not entirely out of the woods on inflation.

Link: https://mailchi.mp/bcrea/canadian-inflation-april-2023

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: