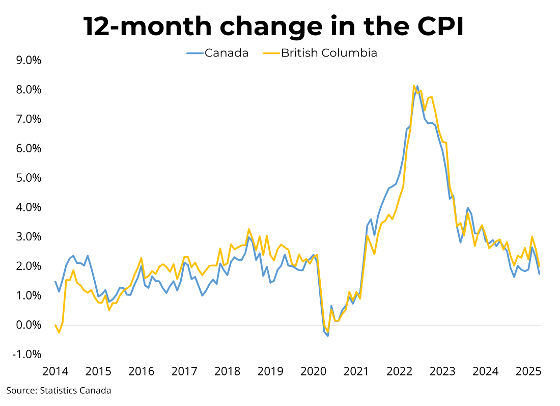

Canadian prices, as measured by the Consumer Price Index (CPI), rose 1.7 per cent on a year-over-year basis in April, down from a 2.3 per cent increase in March. Month-over-month, on a seasonally adjusted basis, the CPI was down 0.2 per cent in April. The overall slowdown in headline CPI is largely driven by lower energy prices, catalyzed by the removal of the consumer carbon tax. The CPI ex-energy rose by 2.9 per cent in April. While shelter costs remain the main driver of inflation, grocery price growth has also outpaced the headline CPI over the past three months, with prices rising 3.8 per cent year-over-year in April. In BC, consumer prices rose 2.0 per cent year-over-year, down from 2.6 per cent in March. The Bank of Canada's preferred measures of median and trimmed inflation, which strip out volatile components, are at 3.2 per cent and 3.1 per cent year-over-year, respectively.

While April's CPI report saw inflation fall comfortably into the target range, several underlying trends illustrate upward pressure on prices across many sub-components beyond energy/gasoline. Moreover, the Bank's core measures of inflation rose above their target range, suggesting that almost all deceleration in the headline CPI was driven by volatile components. Taken together, the Bank faces the decision of either overlooking these pressures in favour of a rate cut or holding its policy rate to defend against further price growth. All eyes shift towards next week's GDP report, which will better show how tariffs are beginning to affect the Canadian economy.

https://mailchi.mp/bcrea/canadian-inflation-april-2025

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: