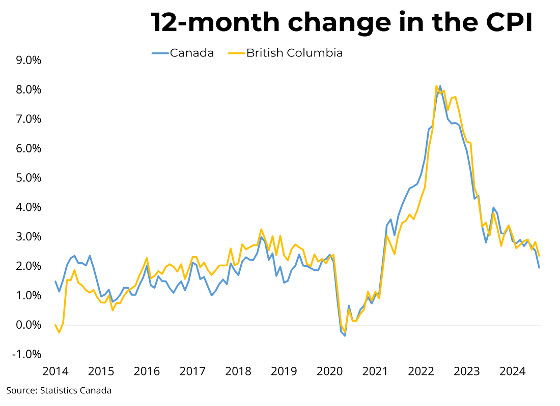

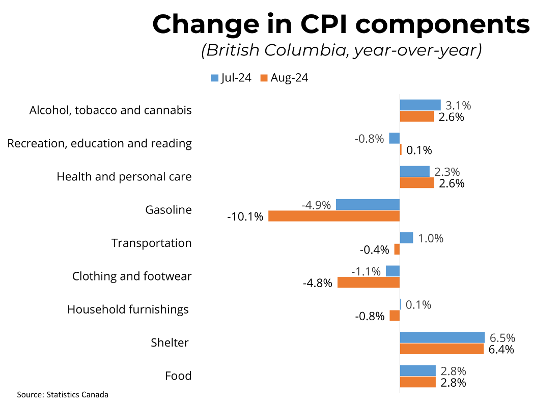

Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.0 per cent on a year-over-year basis in August, down from a 2.5 per cent increase in July. This marks the slowest year-over-year increase since February 2021. Month-over-month, on a seasonally adjusted basis, CPI rose by 0.1 per cent in August. The deceleration in headline CPI was driven by a 5.1 per cent decrease in gasoline prices in August. This drop is largely attributed to base-year effects as well as lower crude oil prices due to lower demand in China and concerns regarding the American economy. Excluding gasoline, the CPI rose 2.2 per cent in August, a fall from 2.5 per cent in July. Mortgage interest costs were up 18.8 per cent, and rent was up 8.9 per cent from last August. Despite steadily decreasing year-over-year growth rates, mortgage interest costs have been the largest contributor to headline CPI since December 2022. Overall, shelter costs rose 5.3 per cent year-over-year in August, down from 5.7 per cent in July. Finally, goods costs fell 0.7 per cent while services costs rose 4.3 per cent year-over-year. In BC, consumer prices rose 2.4 per cent year-over-year, down from 2.8 per cent in July. The Bank of Canada's preferred measures of median and trimmed inflation,which strip out volatile components, fell to 2.3 and 2.4 per cent year-over-year in August, respectively.

Canada's August inflation report marks a significant milestone for the national economy, with headline CPI reaching the midpoint of the Bank of Canada's target range. Despite some downward pressure from base-year effects on gasoline, the prices for several major components of inflation ticked downward nationwide. Moreover, CPI-median and CPI-trim continue declining towards the midpoint of their target ranges. Taken together, August's inflation report bolsters the likelihood of a fourth consecutive rate cut from the Bank of Canada in October. Barring weaker-than-expected monthly GDP and employment, we can expect this cut to be 25 basis points.

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: