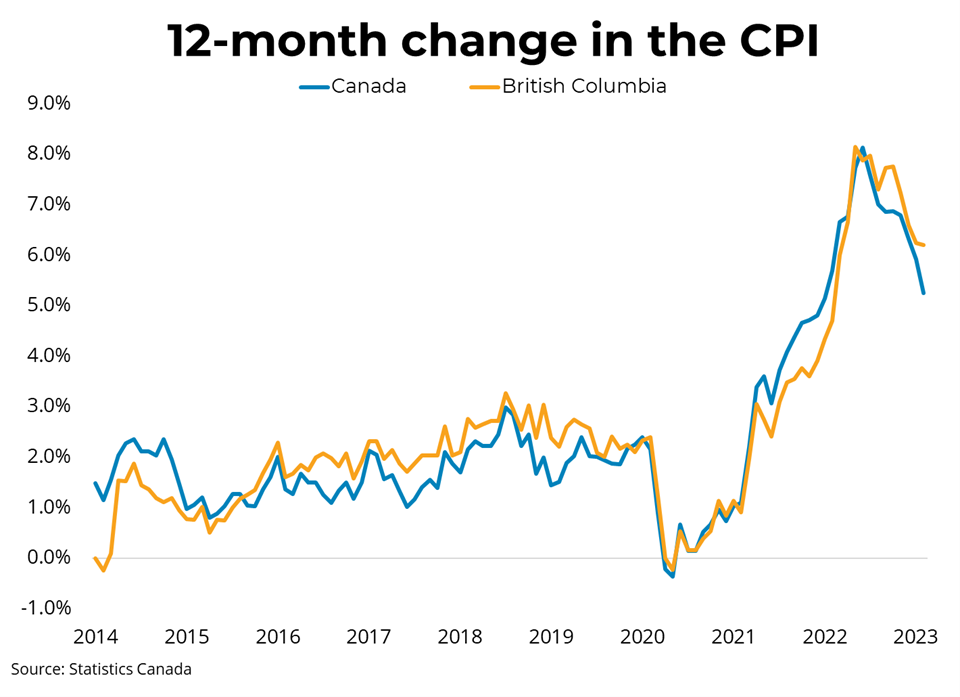

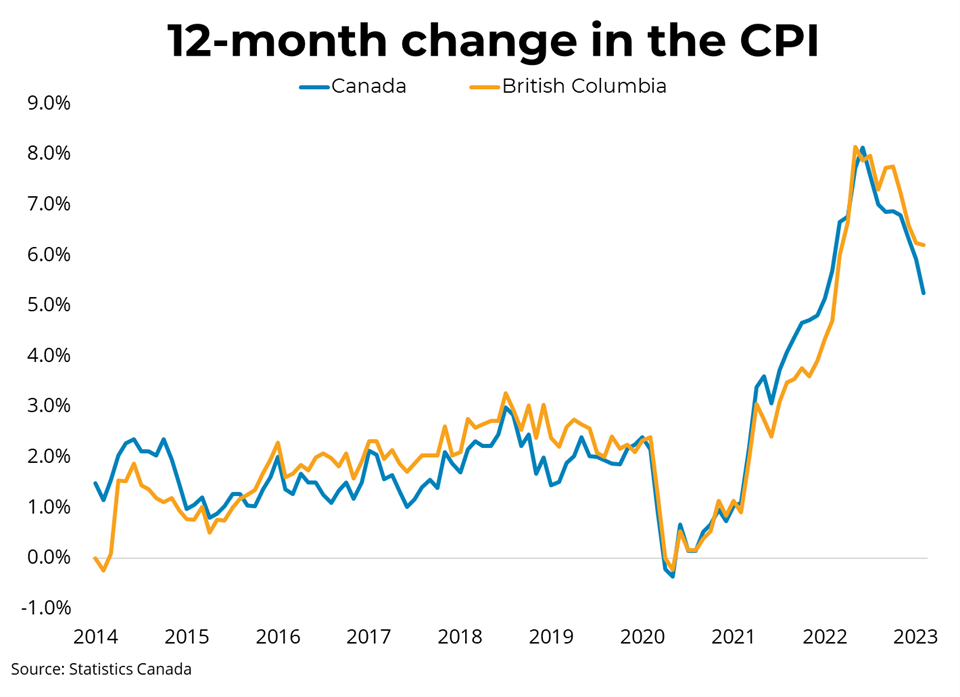

Canadian prices, as measured by the Consumer Price Index (CPI), rose 5.2 per cent on a year-over-year basis in February, a decrease from the 5.9 per cent rate in January. This large drop was mostly due to base year effects, as inflation increased strongly this month last year. Grocery prices continue to rise too-quickly, up 10.6 per cent from last year, the seventh consecutive month of double-digit annual price growth. Mortgage interest costs were up 23.9 per cent year-over-year, the fastest pace since 1982, as Canadians renewed or initiated higher-rate mortgages. In contrast, the Homeowner's Replacement Cost, which tracks home prices, continued to slow, increasing 3.3 per cent year-over-year in February, down from 4.3 per cent in January. Month-over-month, on a seasonally-adjusted basis, prices were up 0.1 per cent in February. In BC, consumer prices rose 6.2 per cent year-over-year.

There continue to be encouraging signs that the bout of rapid price appreciation that began in February of last year is waning. Although food prices continue to rise quickly, most other categories in the index are trending back toward normal price trends. The Bank of Canada's measures of core inflation, which strip out volatile components, each ticked downwards for a third month in a row. The three-month annualized change in seasonally-adjusted CPI is now well within the bank's 1-3 per cent target range, hitting 1.6 per cent in February. Although price appreciation may be moderating, it is still well above the Bank of Canada's 2 per cent target, and while the Bank has announced a conditional pause on further rate hikes, they could change course if inflation does not continue to cool.

Link: https://mailchi.mp/bcrea/canadian-inflation-february-2023

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: