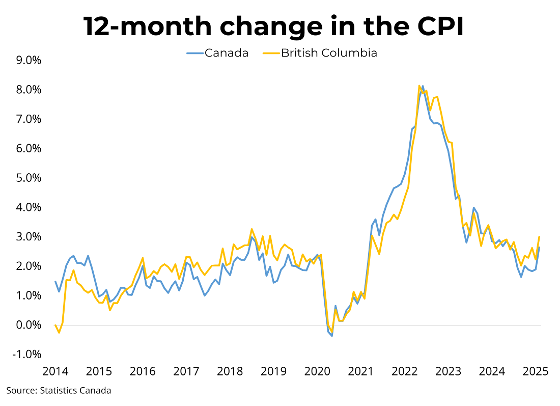

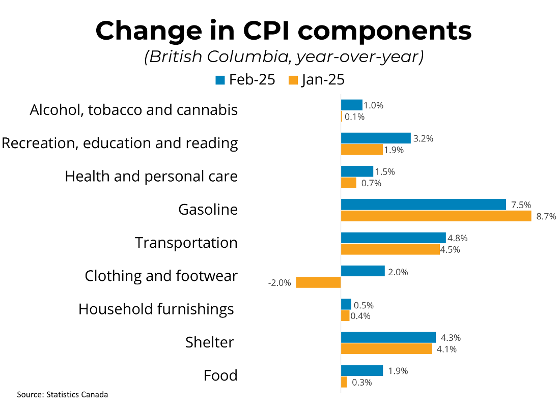

Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.6 per cent on a year-over-year basis in February, up from a 1.9 per cent increase in January. Month-over-month, on a seasonally adjusted basis, CPI increased by 0.7 points in February. Products affected by the end of the GST/HST tax break saw slower year-over-year price declines compared to previous months, placing upward pressure on headline inflation. Overall, shelter price growth continues to cool, as mortgage interest costs were up 9.0 per cent, marking the eighteenth consecutive month of deceleration. Similarly, rent was up 5.8 per cent in February year-over-year, down from 6.3 per cent in January. In BC, consumer prices rose 3.0 per cent year-over-year, up from 2.2 per cent in January. The Bank of Canada's preferred measures of median and trimmed inflation, which strip out volatile components, both rose to 2.9 per cent year-over-year.

February's CPI report saw inflation rise by 0.7 points from the previous month, the largest monthly jump in nearly three years. Most of this movement can be attributed to the end of the tax break mid-month, which halted previous downward pressure from several sub-components. Importantly, February saw further increases in the Bank's core measures for a second consecutive month, which now lie near the upper threshold of their target range. Coupled with looming tariffs in April, this report favours the probability of the Bank holding the overnight rate at its current level during their next meeting.

https://mailchi.mp/bcrea/canadian-inflation-february-2025

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: