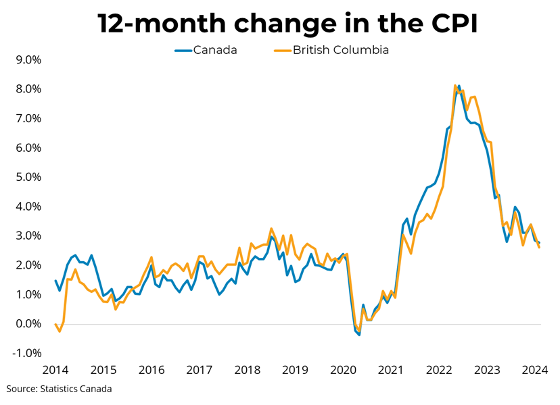

Canadian prices, as measured by the Consumer Price Index (CPI), rose 3.4 per cent on a year-over-year basis in May, down from 4.4 per cent in March. The decline was mostly driven by lower gasoline prices from this time last year (-18.3 per cent). Month over month, CPI rose 0.4 per cent, in large part due to higher mortgage interest and traveler accommodation costs. Shelter costs were up 4.7 per cent year over year, driven by much higher mortgage interest costs (up 29.9 per cent from last year) along with higher rents (up 5.7 per cent from May 2022). The homeowner's replacement cost, which tracks home prices, was down 0.1 per cent year over year. Grocery prices were up 9 per cent year over year, down from 9.1 per cent last month. In BC, consumer prices rose 3.4 per cent year-over-year.

After unexpectedly hot inflation in April, the CPI cooled in May, with year-over-year prices rising at the slowest rate since June 2021. Much lower gasoline prices compared to the same time last year are doing much of this work, but recovering supply chains also contributed, with furniture and household appliances both on average cheaper than the same time last year. The Bank of Canada's measures of core inflation, which strip out volatile components, are trending downwards and are now mostly below 4 per cent year-over-year. Despite this progress, other components of the CPI remain stubbornly high, particularly food and shelter costs. Excluding energy prices, the CPI was up 4.6 per cent from last year, a rate that is still well beyond the Bank's target. In the context of solid GDP growth, a robust labour market, and a rebounding housing market, financial markets expect that the Bank will raise its benchmark interest rate by another 25 basis points to 5 per cent at its next meeting on July 12th.

Link: https://mailchi.mp/bcrea/canadian-inflation-may-2023

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: