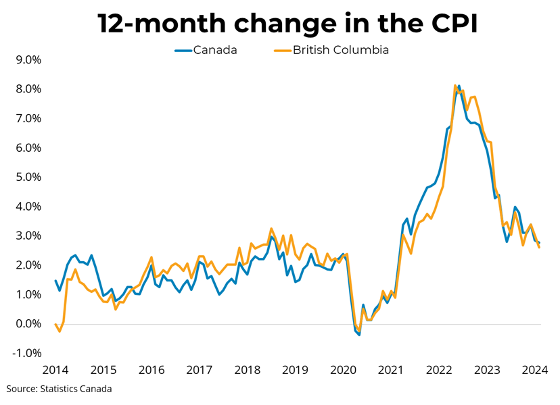

Canada's inflation rate came in higher than expected in May, halting a string of good reports since the start of the year. The Bank of Canada's preferred measures of core inflation, CPI median and CPI trim, jumped back above the 2 per cent target when measured on a 3-month annualized basis. Food prices ticked up sharply last month after remaining flat or declining in every prior month since the start of the year. Rents remain the most troubling component of the CPI bundle, and still show no signs of slowing down. Rents rose 9.3 percent over the last 4 months on an annualized basis. While one month does not make a trend, the probability of an additional rate cut by the Bank of Canada in July declined following the report. The Bank will be watching the forthcoming employment and GDP reports closely to guide its decision prior to the next announcement on Wednesday, July 24th.

Link: https://mailchi.mp/bcrea/canadian-inflation-may-2024-june-25-2024

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: