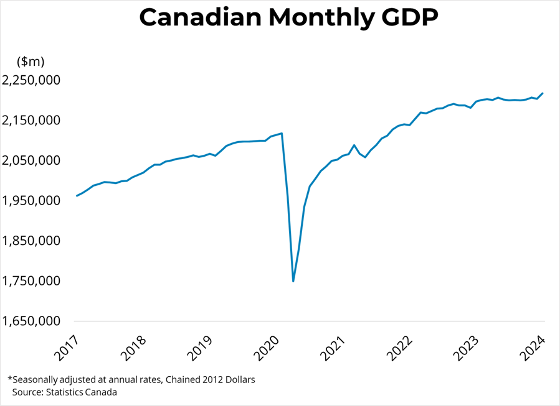

Canadian real GDP was flat in March. Service-producing industries were unchanged from the prior month which goods producing industries edged down 0.1 per cent. Canadian real GDP is now roughly 3.6 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy rose 0.2 per cent in April.

GDP grew 0.8 per cent in the first quarter of 2023, following roughly zero growth in the previous quarter. Almost all of this growth was concentrated in the month of January. Goods-producing sectors rose 0.1 per cent while services-producing sectors rose 0.9 per cent. The public sector (educational services, health care and social assistance, and public administration) was the largest contributor to growth for the third consecutive quarter. Exports rose 2.4 per cent in the first quarter, while imports rose just 0.2 per cent, spurring growth. Higher household spending on goods (1.5 per cent) and services (1.3 per cent) also pushed GDP upwards. Higher borrowing costs, meanwhile, caused housing investment to fall 3.9 per cent in the first quarter, with new construction (-6.0 per cent), renovations (-2.1 per cent), and ownership transfer costs (-1.5 per cent) all declining. Compensation of employees rose 1.7 per cent from the prior quarter, but disposable income nevertheless fell 1 per cent largely as a result of lower government transfers compared to last quarter.

Canadian GDP outpaced expectations in the first quarter, expanding 3.1 per cent on an annualized basis. Following over a year of rate hikes from the Bank of Canada, the economy remains robust in many areas. A burst of economic growth at the start of the year supported a high first quarter growth rate, but April's preliminary GDP estimate shows growth continuing into the second quarter. Although housing markets swooned in the immediate aftermath of rate hikes, in recent months they have shown signs of a solid recovery. At 5 per cent, the Canadian unemployment rate remains near record lows. Meanwhile, inflation remains hot, with the year-over-year rate increasing to 4.4 per cent in April from 4.3 per cent in March. These indicators will put some pressure on the central bank to potentially change course following its 'conditional pause' on further rate hikes as of January. The Bank's rate decision next Wednesday will need to balance persistently hot numbers with the risk of overtightening given the long lags of monetary policy.

Link: https://mailchi.mp/bcrea/canadian-economic-growth-real-gdp-q12023

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: