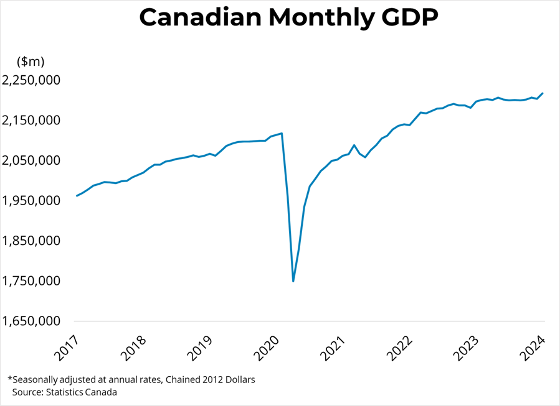

Canadian real GDP was largely unchanged from the prior month in July, following a 0.2 per cent decrease in June. A decline in manufacturing activity (-1.5 per cent) pulled GDP downwards with lower inventory formation and the BC port strike as the major contributors. Meanwhile, as wildfires retreated in Eastern Canada, the mining and quarrying sector jumped 4.2 per cent. Offices of real estate agents and brokers fell 1.3 per cent, declining for the first time in 6 months. Overall, Canadian real GDP is now 3.6 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy edged up 0.1 per cent in August.

July’s GDP number came in flat as anticipated, and although economic growth appears to be softening amid rising interest rates, the advanced estimate for August remains in weakly positive territory. The Bank of Canada held its overnight rate steady at 5 per cent in September, but last week’s inflation number was hotter than anticipated, causing financial markets to revise expectations. Markets now anticipate an additional rate hike before the end of the year. With the Canadian economy continuing to avoid recession, inflation at 4 per cent, and an unemployment rate still at a rather robust 5.5 per cent, an additional rate hike in October seems likely. However, the Bank will be paying close attention to CPI and employment data before the announcement on the 25th.

Link: https://mailchi.mp/bcrea/canadian-real-gdp-growth-july-2023

For more information, please contact: Gino Pezzani.

Comments:

Post Your Comment: