Posted on

April 21, 2024

by

Gino Pezzani

In a small village nestled between a forest and the hills, there lived an old man known for his wisdom. One evening, as the sun painted the sky with hues of orange and purple, he sat outside his quaint cottage with his young grandson, who always yearned for his stories and lessons about life.

In a small village nestled between a forest and the hills, there lived an old man known for his wisdom. One evening, as the sun painted the sky with hues of orange and purple, he sat outside his quaint cottage with his young grandson, who always yearned for his stories and lessons about life.

"Grandfather," the boy said, "tell me, what is the most important lesson for a person to learn?"

The man smiled and gazed into the distance, where the shadows of the trees were merging with the night. "Inside each of us is a fierce battle that rages on," he said. "It's like two wolves constantly at war with each other.

One wolf represents darkness and despair—it is anger, jealousy, regret, greed, arrogance, self-pity, guilt, resentment, inferiority, lies, false pride, superiority and ego. It thrives on our worst impulses and feeds on our failures.

"The other wolf embodies light and hope—it is joy, peace, love, hope, calmness, humility, kindness, empathy, generosity and faith."

The boy, absorbed in his grandfather's words, asked with a sense of urgency, "But, grandfather, if they are always fighting, which wolf wins?"

The man looked deeply into his grandson's eyes and said softly, "The one you feed, my child. The one you feed.

The darkness wolf may seem strong and overpowering at times, and it's easy to feed it with our fears and anger. But the light wolf, though sometimes harder to nurture, has the power to fill our lives with meaning and joy."

In a small village nestled between a forest and the hills, there lived an old man known for his wisdom. One evening, as the sun painted the sky with hues of orange and purple, he sat outside his quaint cottage with his young grandson, who always yearned for his stories and lessons about life.

In a small village nestled between a forest and the hills, there lived an old man known for his wisdom. One evening, as the sun painted the sky with hues of orange and purple, he sat outside his quaint cottage with his young grandson, who always yearned for his stories and lessons about life.

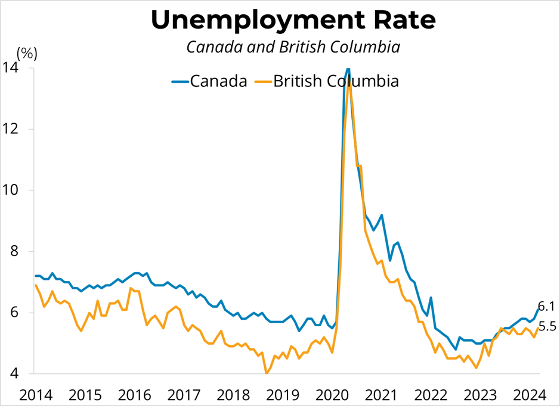

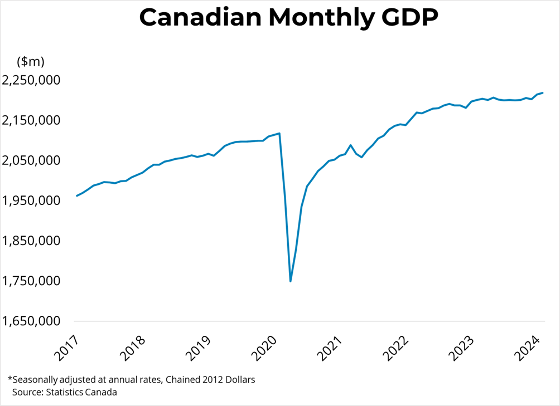

The Bank of Canada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that while the Canadian economy appears to have entered into a phase of excess supply, it expects growth in the Canadian economy to pick up this year and next. On inflation, the Bank cited that inflation is still too high and risks remain, and that shelter inflation is still very elevated. However, both CPI and core inflation have eased in recent months and 3-month annualized measures suggest downward momentum. The Bank will continue to look for evidence that this downward momentum is sustained.

The Bank of Canada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that while the Canadian economy appears to have entered into a phase of excess supply, it expects growth in the Canadian economy to pick up this year and next. On inflation, the Bank cited that inflation is still too high and risks remain, and that shelter inflation is still very elevated. However, both CPI and core inflation have eased in recent months and 3-month annualized measures suggest downward momentum. The Bank will continue to look for evidence that this downward momentum is sustained.