To view the full interactive BCREA Housing Forecast, click here.

To view the BCREA Housing Forecast PDF, click here.

BCREA 2025 Second Quarter Housing Forecast

Vancouver, BC – April 2025. The British Columbia Real Estate Association (BCREA) released its 2025 Second Quarter Housing Forecast today.

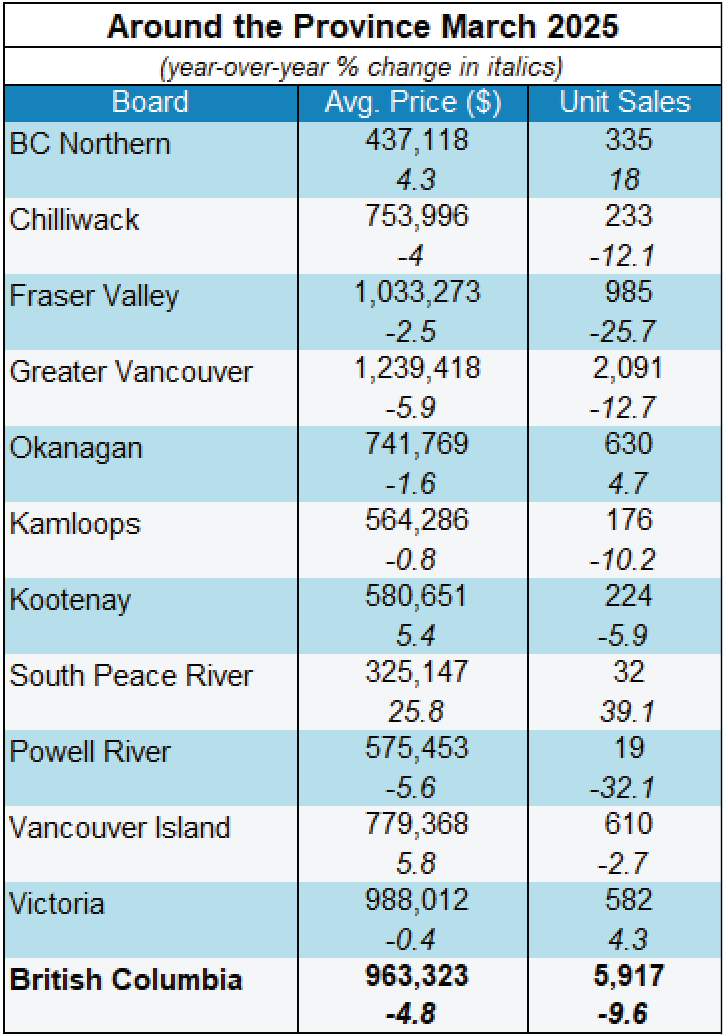

Multiple Listing Service® (MLS®) residential sales in BC are forecast to fall 1.1 per cent to 73,650 units this year. In 2026, MLS® residential sales are forecast to move slightly higher, rising 8.8 per cent to 80,150 units.

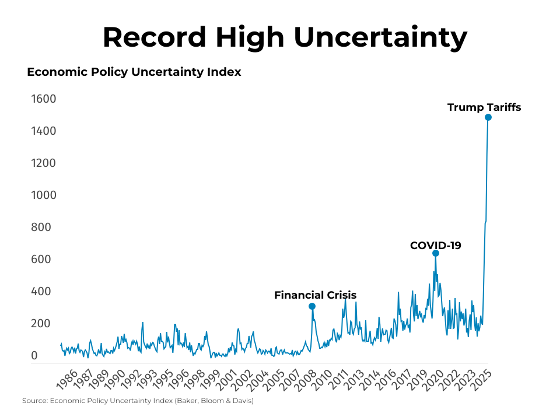

“Hopes for a return to normalcy in the BC housing market were swiftly dashed this year, upended by a pointless and mutually destructive trade war,” said BCREA Chief Economist Brendon Ogmundson. “While there is significant pent-up demand in the market, uncertainty about the direction of the economy is holding that demand back.”

With slower sales, provincial resale inventory is likely to average above 40,000 listings for the first time in over a decade. As a result, we expect average prices in some regions or market segments to face some downward pressure. Overall, however, we forecast largely flat average prices as sellers wait out the current environment.

For more information, please contact: Gino Pezzani.

For the complete news release, including detailed statistics, click here.

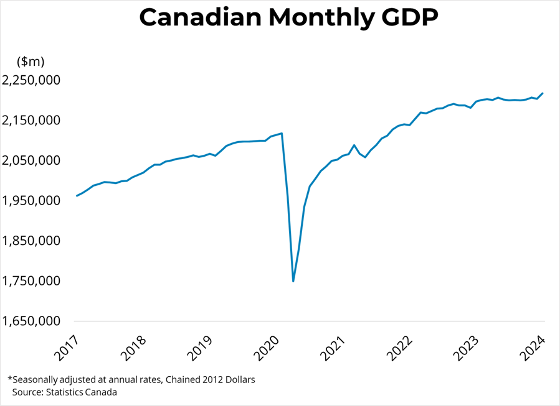

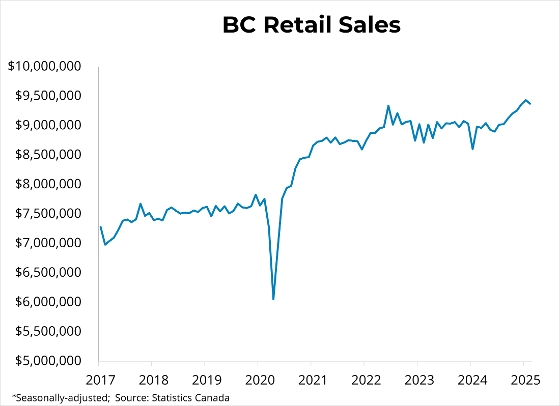

The Bank of Canada held its overnight policy rate at 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted that pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada. The Bank sees two potential scenarios for the Canadian economy, either high but limited tariffs that temporarily weaken growth or a protracted trade war that causes both a full recession and inflation to rise above 3 per cent. The Bank is already seeing signs of a slower economy due to the impact of uncertainty on consumer and business confidence, but expects tariff driven supply chain disruptions will put upward pressure on prices later this year. Perhaps most importantly, the Bank ended its statement with the following: "

The Bank of Canada held its overnight policy rate at 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted that pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada. The Bank sees two potential scenarios for the Canadian economy, either high but limited tariffs that temporarily weaken growth or a protracted trade war that causes both a full recession and inflation to rise above 3 per cent. The Bank is already seeing signs of a slower economy due to the impact of uncertainty on consumer and business confidence, but expects tariff driven supply chain disruptions will put upward pressure on prices later this year. Perhaps most importantly, the Bank ended its statement with the following: "