Posted on

August 29, 2023

by

Gino Pezzani

BCREA 2023 Third Quarter Housing Forecast

Vancouver, BC – August, 2023. The British Columbia Real Estate Association (BCREA) released its 2023 Third Quarter Housing Forecast Update today.

Multiple Listing Service® (MLS®) residential sales in BC are forecast to decline 2.8 per cent to 78,640 units this year. In 2024, MLS® residential sales are forecast to post a modest rebound, rising 6.1 per cent to 83,425 units.

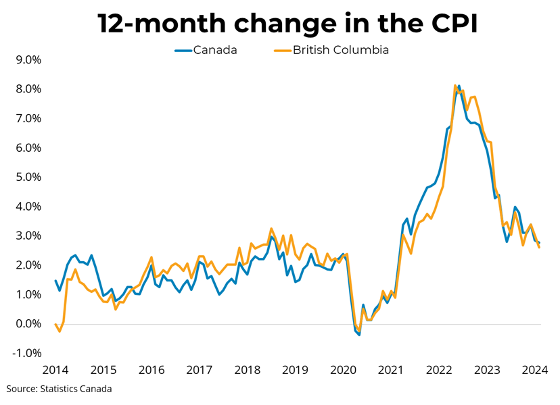

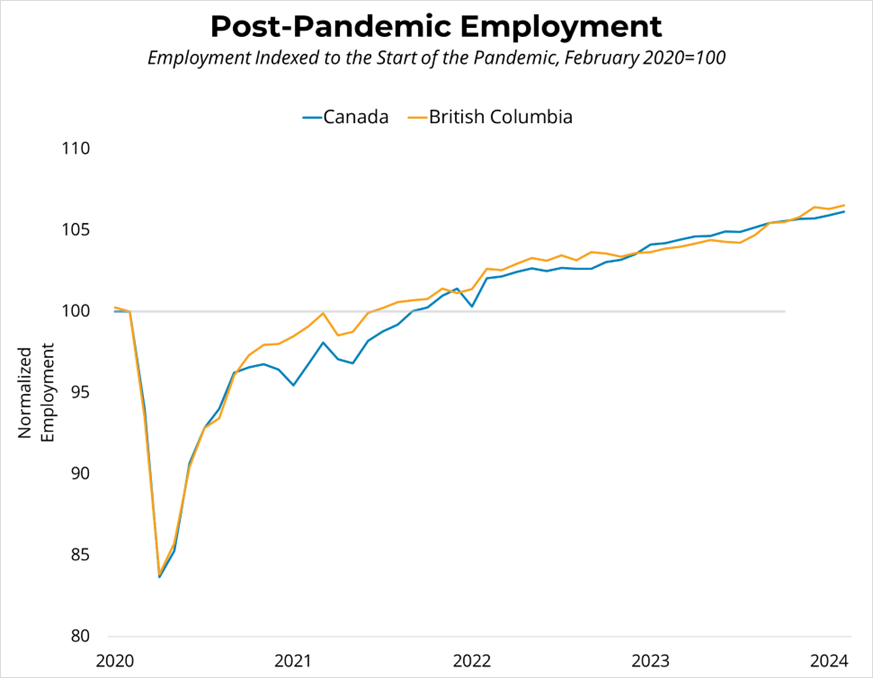

“The BC housing market has been more resilient than expected in 2023, with both home sales and prices holding up well in the face of sharply higher interest rates,” said BCREA Chief Economist Brendon Ogmundson. “However, we expect sales to cool as the result of renewed Bank of Canada tightening and a delay in expectations regarding the timing of future Bank of Canada rate cuts from early next year to perhaps the end of 2024 or even mid-2025.”

“The BC housing market has been more resilient than expected in 2023, with both home sales and prices holding up well in the face of sharply higher interest rates,” said BCREA Chief Economist Brendon Ogmundson. “However, we expect sales to cool as the result of renewed Bank of Canada tightening and a delay in expectations regarding the timing of future Bank of Canada rate cuts from early next year to perhaps the end of 2024 or even mid-2025.”

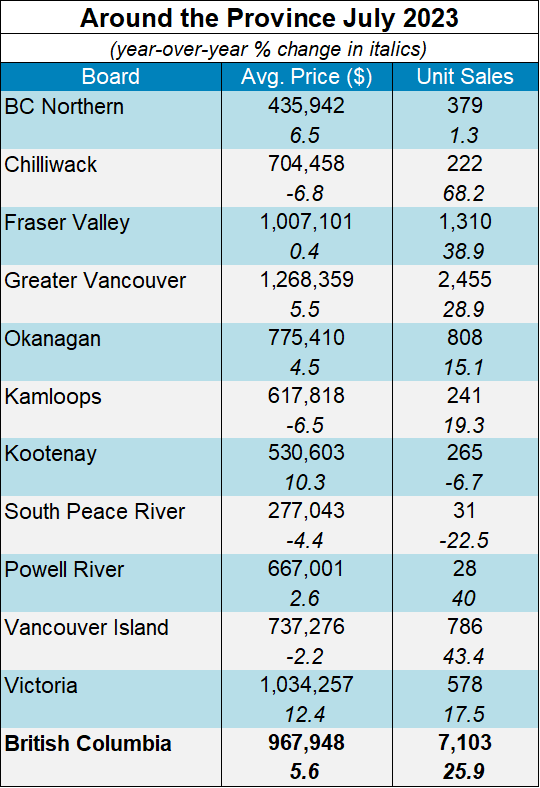

Because inventory remains very low, prices rose through much of 2023 despite below-average sales. The average price in BC has varied widely throughout this year, beginning the year below $900K before reaching just over $1 million in May as sales in more expensive markets surged amid dwindling supply. If the average price trends near its current level of $970K over the year's second half, it would mean an annual average price of $976K in 2023, or a 2 per cent decline compared to 2022. As home sales return to normal levels next year, we anticipate prices will rise 2.4 per cent to an annual average of just over $1 million, though there is risk to the upside on price growth given the state of housing supply.

For the complete news release, including detailed statistics, click here.

To view the BCREA Housing Forecast Update PDF, click here.

For more information, please contact: Gino Pezzani.

“The BC housing market has been more resilient than expected in 2023, with both home sales and prices holding up well in the face of sharply higher interest rates,” said BCREA Chief Economist Brendon Ogmundson. “However, we expect sales to cool as the result of renewed Bank of Canada tightening and a delay in expectations regarding the timing of future Bank of Canada rate cuts from early next year to perhaps the end of 2024 or even mid-2025.”

“The BC housing market has been more resilient than expected in 2023, with both home sales and prices holding up well in the face of sharply higher interest rates,” said BCREA Chief Economist Brendon Ogmundson. “However, we expect sales to cool as the result of renewed Bank of Canada tightening and a delay in expectations regarding the timing of future Bank of Canada rate cuts from early next year to perhaps the end of 2024 or even mid-2025.”