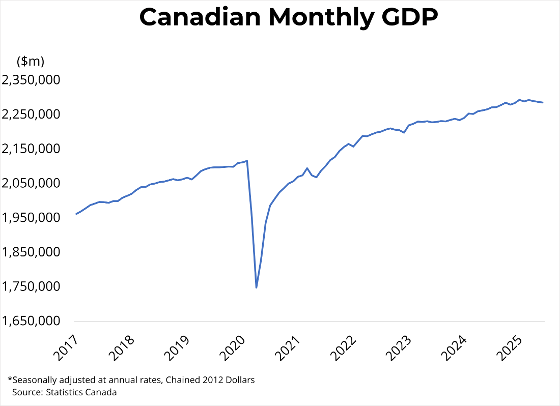

Canadian real GDP fell by 0.1 per cent in June, after declining by 0.1 per cent in May. Goods-producing sectors fell 0.5 per cent, while service-producing industries increased by 0.1 per cent. Sectoral growth was led by retail trade (1.4 per cent), wholesale trade (0.5 per cent), and construction (0.3 per cent). The biggest detractors from growth were from manufacturing (-1.5 per cent) and utilities (-1.2 per cent). Output for the offices of real-estate agents and brokers rose by 3.1 per cent month-over-month. Preliminary estimates suggest that real GDP by industry increased by 0.1 per cent in July.

Real GDP declined by 0.4 per cent in the second quarter of 2025, registering an annualized growth rate of -1.6 per cent. Contraction was driven by a broad-based slowdown in trade, with exports and imports falling by 7.5 per cent and 1.3 per cent, respectively. Business investment fell by 0.6 per cent, driven by slower investment in machinery and equipment (-9.4 per cent). Meanwhile, slightly higher investment in residential structures (1.5 per cent) was offset by its non-residential counterpart (-3.3 per cent). Household spending rose 1.1 per cent in the second quarter, while the household savings rate fell a full point to 5.0 per cent, driven by weakening income growth. On a per capita basis, GDP fell 0.4 per cent in Q2 after increasing by 0.4 per cent in the previous quarter.

As many feared, the consequences of tariffs on the Canadian economy are reflected in this print, with Q2 GDP growth falling below the Bank of Canada's most recent projection. Contraction is largely attributable to far lower trade, offsetting the export growth which propelled the economy forward during Q1 as companies tried to get ahead of tariffs. Moreover, the associated uncertainty of volatile trade policy hampered investment from Canadian businesses, creating a further drag on growth. This report could influence the Bank of Canada towards a rate cut during their next meeting in hopes of re-igniting the economy moving into the fall. Moving forward, the Bank of Canada will closely watch next month's inflation data for signs that core inflation is moderating to its 2% target, such that it can more confidently commit to a 25-point cut in September.

For more information regarding British Columbia's GDP growth, please visit our Nowcast for an estimate of economic activity throughout the province:

https://infogram.com/1pd36dxvpnw629umvzqqzd69rrskqe1dm5k

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.

https://mailchi.mp/bcrea/canadian-economic-growth-real-gdp-q2-2025

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.