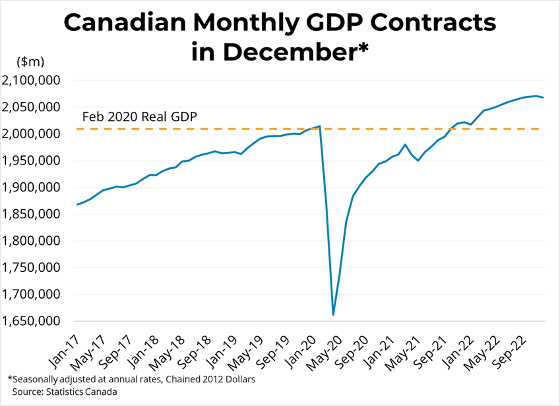

Canadian real GDP declined 0.1 per cent in December, the first monthly decline since January of 2022. The decline in GDP was concentrated among goods-producing industries (-0.6 per cent) while services were flat. Canadian real GDP is now roughly 2.7 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy rose 0.3 per cent in January.

Growth in the fourth quarter of 2022 was nearly unchanged from the prior quarter, following five consecutive quarters of positive growth. Declines in business inventories and business investment balanced out higher consumer and government spending and more favorable net trade. Housing investment fell 2.3 per cent on higher interest rates, as with home renovations (-2.6 per cent), new home construction (-1.4 per cent), and ownership transfer costs (-4 per cent). Overall, housing investment declined 11.1 per cent in 2022. Business investment in non-residential structures, in contrast, rose 2.5 per cent from the prior quarter, with higher investment in engineering structures driven by construction at LNG Canada's export terminal in Kitimat.

Flat GDP numbers in the fourth quarter continue to indicate slowing in the Canadian economy. Growth in the fourth quarter was softer than expected, providing support for the Bank of Canada's decision to put a 'conditional pause' on further rate hikes as of January. However, with the overnight rate rising 425 basis points in under a year, growth is likely to remain sluggish in the coming quarters as prior rate tightening works its way through the economy.

Link: https://mailchi.mp/bcrea/canadian-economic-growth-real-gdp-q42022

For more information, please contact: Gino Pezzani.

Link:

Link: