Posted on

July 7, 2023

by

Gino Pezzani

Vancouver, B.C. – June, 2023 – Commercial real estate sales and dollar volumes had a slow start to 2023, with year-over-year declines across all property types.

There were 273 commercial real estate sales in the Lower Mainland in Q1 2023, a 58.1 per cent decrease from 651 sales in Q1 2022, according to data from Commercial Edge, a commercial real estate system operated by the Real Estate Board of Greater Vancouver (REBGV).

The total dollar value of commercial real estate sales in the Lower Mainland was $1.483 billion in Q1 2023, a 64.8 per cent decrease from $4.213 billion in Q1 2022.

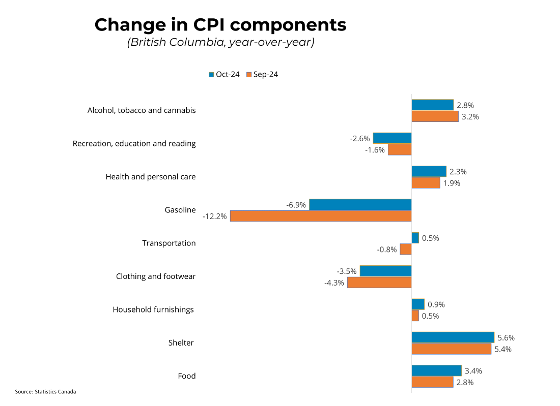

“Not to sound like a broken record, but it’s hard to ignore the cooling impact higher borrowing costs have had on transactions in the real estate market overall, and the commercial market remains no exception,” Andrew Lis, REBGV’s Director of Economics and Data Analytics, said. “With a 0.25 per cent hike to the Bank of Canada’s policy rate in June, and the possibility of another 0.25 per cent hike in July, relief doesn’t appear to be on the near-term horizon. That said, the silver lining is that inflation is heading in the right direction and is finally nearing the Bank of Canada’s target range of one to three per cent, suggesting that the need for any dramatic increases to the policy rate from here on is unlikely.”

Q1 2023 activity by category

Land: There were 86 commercial land sales in Q1 2023, which is a 60.7 per cent decrease from the 219 land sales in Q1 2022. The dollar value of land sales was $896 million in Q1 2023, a 62 per cent decrease from $2.356 billion in Q1 2022.

Office and Retail: There were 113 office and retail sales in the Lower Mainland in Q1 2023, which is down 53.7 per cent from the 244 sales in Q1 2022. The dollar value of office and retail sales was $172 million in Q1 2023, a 78.8 per cent decrease from $811 million in Q1 2022.

Industrial: There were 63 industrial land sales in the Lower Mainland in Q1 2023, which is a 58.6 per cent decrease from the 152 sales in Q1 2022. The dollar value of industrial sales was $322 million in Q1 2023, a 50.7 per cent decrease from $653 million in Q1 2022.

Multi-Family: There were 11 multi-family land sales in the Lower Mainland in Q1 2023, which is down 69.4 per cent from 36 sales in Q1 2022. The dollar value of multi-family sales was $93 million in Q1 2023, a 76.3 per cent decrease from $392 million in Q1 2022.

Download the Q1 2023 Commercial Stats Package.

For more information, please contact: Gino Pezzani.

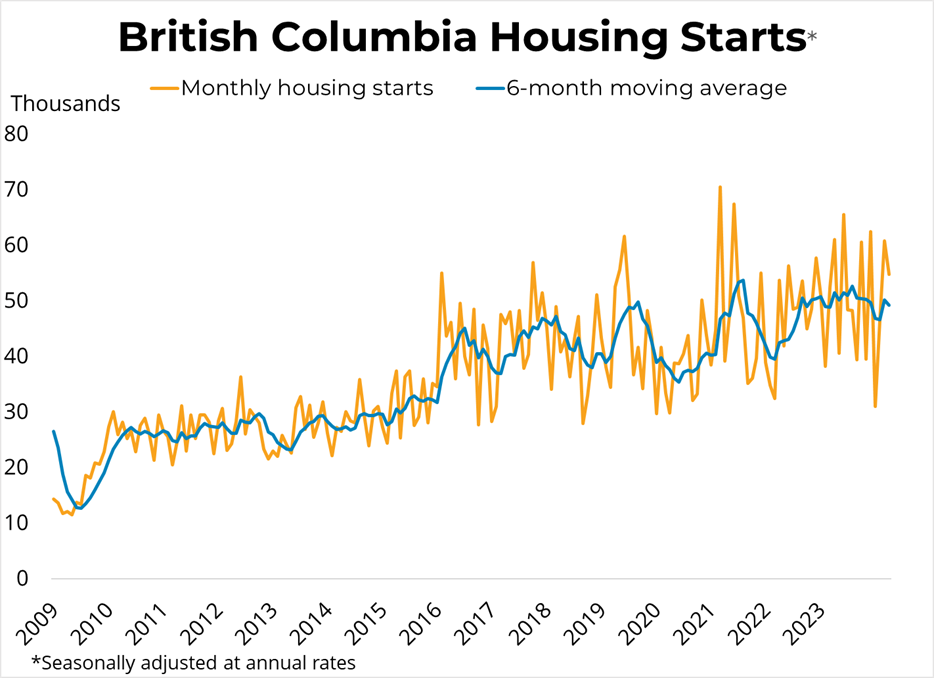

The BCREA Economics team has created the Housing Monitor Dashboard to help REALTORS® monitor BC’s housing market. This dashboard provides up-to-date data on key variables for public education and use. The image and data are available for download under each chart, where possible.

The BCREA Economics team has created the Housing Monitor Dashboard to help REALTORS® monitor BC’s housing market. This dashboard provides up-to-date data on key variables for public education and use. The image and data are available for download under each chart, where possible.

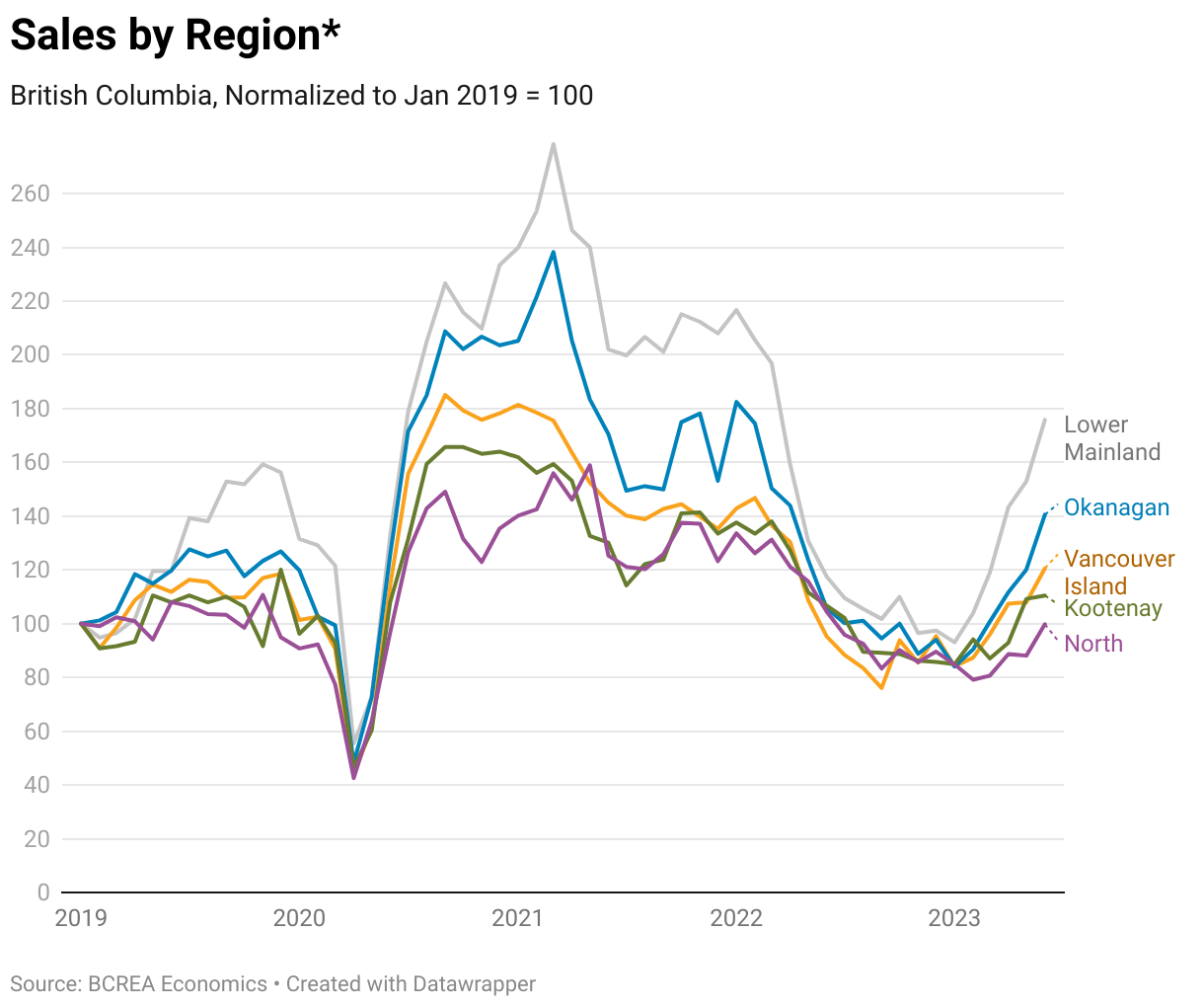

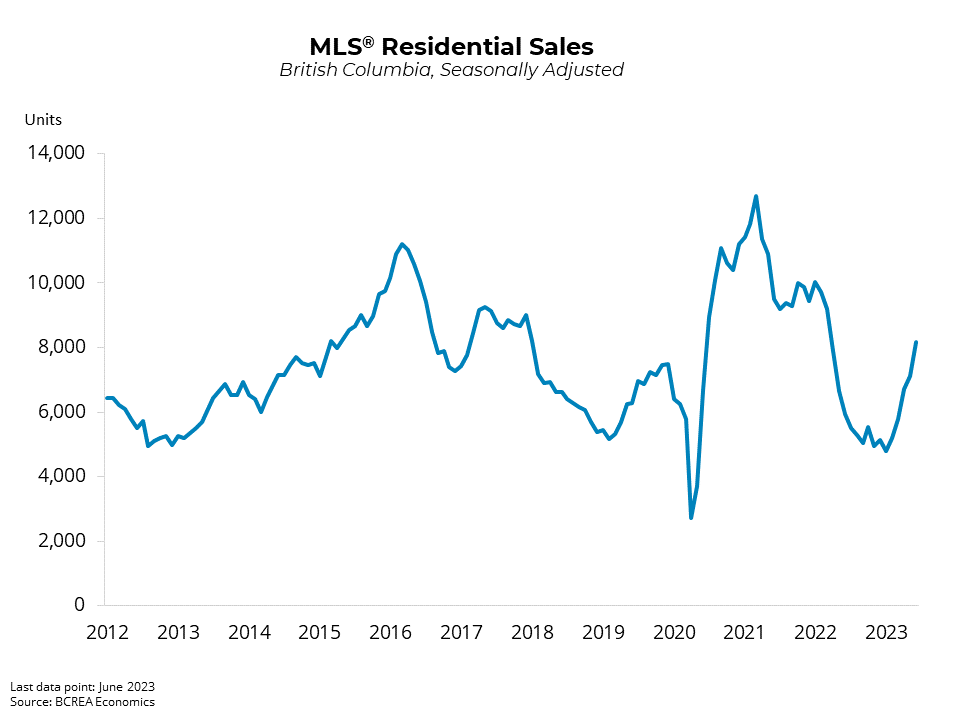

“June home sales continued to outperform expectations, following a very strong rebound in May,” said BCREA Chief Economist Brendon Ogmundson. “However, rising interest rates will likely dampen home sales activity in coming months.”

“June home sales continued to outperform expectations, following a very strong rebound in May,” said BCREA Chief Economist Brendon Ogmundson. “However, rising interest rates will likely dampen home sales activity in coming months.”

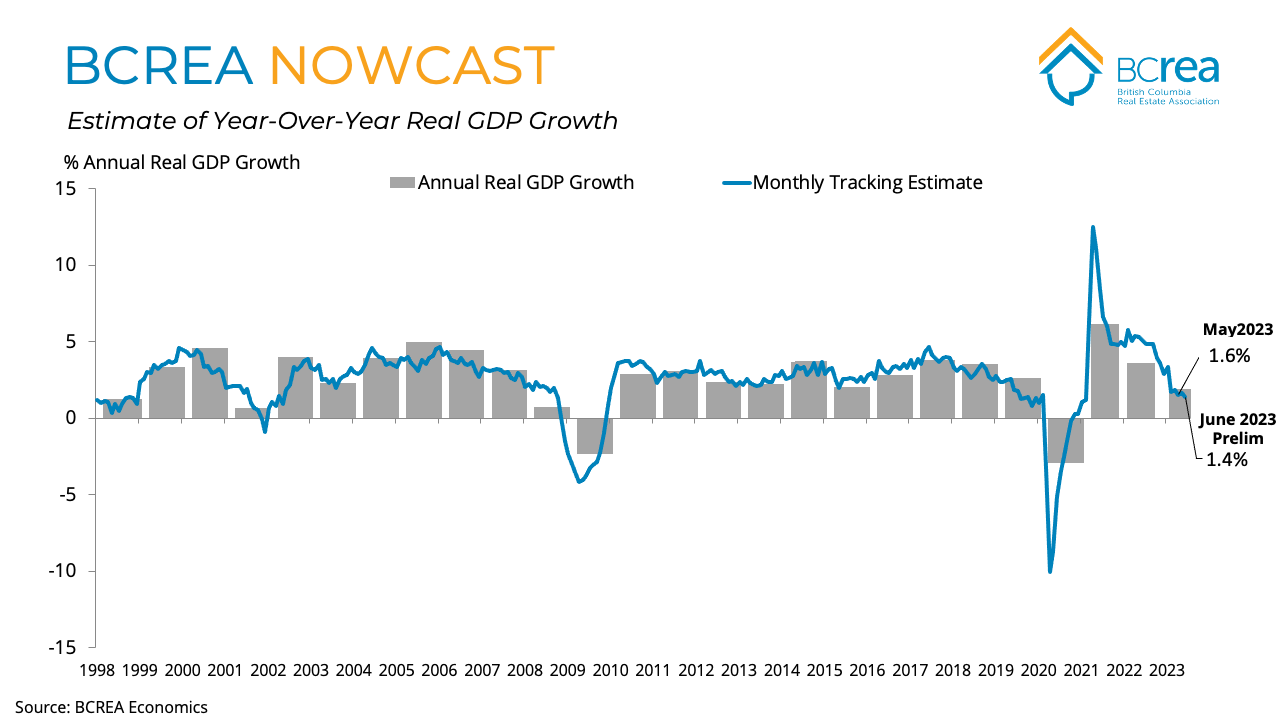

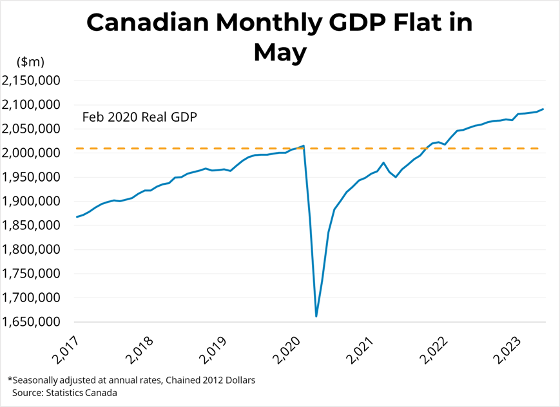

The Bank of Canada raised its overnight rate by 25 basis points to 5 per cent this morning. In the statement accompanying the decision, the Bank noted that the Canadian economy has been stronger than expected but is expected slow as higher interest rate work their way through the economy. On inflation, the Bank cited the recent easing of inflation to 3.4 per cent but also noted that core inflation continues to run a at 3 to 4 per cent pace and has been more persistent than anticipated. The Bank now forecasts a return to its 2 per cent target in mid-2025 rather than in 2024.

The Bank of Canada raised its overnight rate by 25 basis points to 5 per cent this morning. In the statement accompanying the decision, the Bank noted that the Canadian economy has been stronger than expected but is expected slow as higher interest rate work their way through the economy. On inflation, the Bank cited the recent easing of inflation to 3.4 per cent but also noted that core inflation continues to run a at 3 to 4 per cent pace and has been more persistent than anticipated. The Bank now forecasts a return to its 2 per cent target in mid-2025 rather than in 2024.