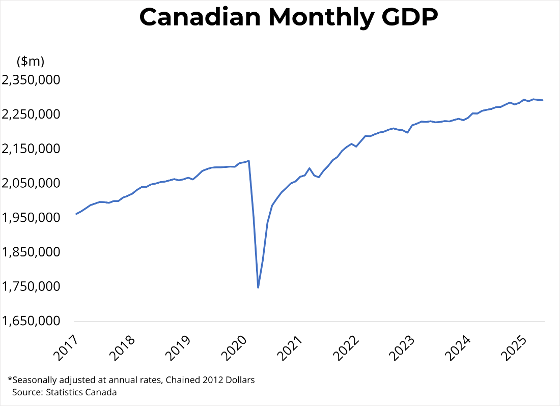

Canadian real GDP decreased by 0.1 per cent in May, following a 0.1 per cent decrease in April. Service-producing industries remained unchanged, while goods-producing industries edged down by 0.1 per cent. Thirteen out of twenty major industries contracted from the previous month, led by broad-based decreases in retail trade (-1.2 per cent), mining, quarrying, and oil and gas (-1.0 per cent) and public administration (-0.2 per cent). Conversely, both the manufacturing (0.7 per cent) and transportation/warehousing (0.6 per cent) sectors grew following contractions in April. Finally, GDP for real estate offices and agents was up 3.5 per cent month-over-month. Preliminary estimates suggest that real GDP increased by 0.1 per cent in June while remaining unchanged for the second quarter of 2025.

Canadian real GDP decreased by 0.1 per cent in May, following a 0.1 per cent decrease in April. Service-producing industries remained unchanged, while goods-producing industries edged down by 0.1 per cent. Thirteen out of twenty major industries contracted from the previous month, led by broad-based decreases in retail trade (-1.2 per cent), mining, quarrying, and oil and gas (-1.0 per cent) and public administration (-0.2 per cent). Conversely, both the manufacturing (0.7 per cent) and transportation/warehousing (0.6 per cent) sectors grew following contractions in April. Finally, GDP for real estate offices and agents was up 3.5 per cent month-over-month. Preliminary estimates suggest that real GDP increased by 0.1 per cent in June while remaining unchanged for the second quarter of 2025.

May's GDP data points to continued weakness through the second quarter, as the impact of tariffs continues to filter through the Canadian economy. Following another rate hold yesterday, the Bank of Canada reiterated its concern about propelling core inflation beyond its already elevated level through monetary policy. Therefore, even in the face of ongoing negative growth, the Bank will likely need to see trimmed and median inflation moderate toward its midpoint before cutting the overnight rate. With that being said, attention now shifts towards August's CPI and GDP prints, which will illustrate how the Canadian economy performed in the second quarter relative to the Bank's most recent projections—a comparison that will heavily influence its next policy decision in mid-September.

https://mailchi.mp/bcrea/canadian-economic-growth-may-2025

For more information, please contact: Gino Pezzani.

The Bank of Canada held its overnight policy rate at 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted that US tariffs are disrupting trade overall, but the economy is showing some resilience. That said, GDP likely declined by 1.5% in the second quarter as the tariff driven import behaviour by US firms that spurred Canadian exports in the first quarter reversed in the second quarter. Moreover, uncertainty is restraining business and household spending, and labour market conditions are weakening in sectors affected by trade. On inflation, the Bank sees underlying inflation trending around 2.5% but with risks of upward pressure due to tariffs.

The Bank of Canada held its overnight policy rate at 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted that US tariffs are disrupting trade overall, but the economy is showing some resilience. That said, GDP likely declined by 1.5% in the second quarter as the tariff driven import behaviour by US firms that spurred Canadian exports in the first quarter reversed in the second quarter. Moreover, uncertainty is restraining business and household spending, and labour market conditions are weakening in sectors affected by trade. On inflation, the Bank sees underlying inflation trending around 2.5% but with risks of upward pressure due to tariffs.