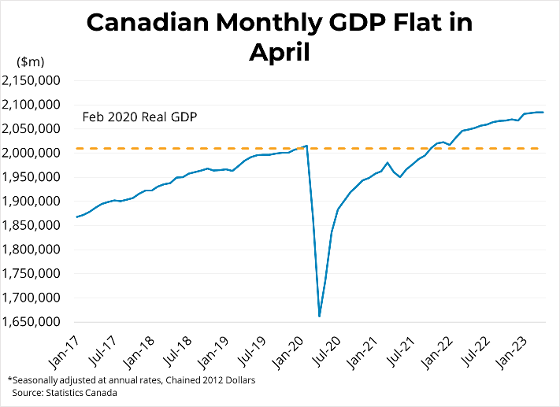

Canadian real GDP was flat from the prior month in April, following a 0.1 per cent increase in March. Goods-producing sectors of the economy grew 0.1 per cent while services-producing sectors were flat. Construction activity rose 0.4 per cent as lower residential construction activity was offset by other subsectors, including engineering construction (+1.1 per cent). The real estate and rental leasing sector expanded 0.5 per cent in April as home sales rebounded. Canadian real GDP is now roughly 3.7 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy expanded 0.4 percent in May.

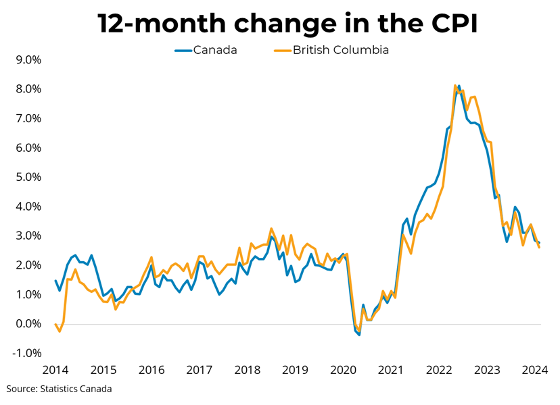

April's GDP read extends a trend of weak but positive growth since February. The strike of federal workers caused public sector GDP to decline 0.3 per cent in April and contributed to a solid rebound in May, estimated preliminarily at 0.4 per cent. Despite low growth, the economy remains relatively resilient given the headwinds of rising interest rates. Furthermore, given the widespread expectation of an imminent recession for at least the prior two quarters, that growth has been positive in all months of 2023 so far is an unexpectedly cheerful development. But monetary policy works with a long lag, and further slowing of GDP and labour markets are widely expected in the second half of the year. The Bank of Canada's goal is to guide inflation back down to 2 per cent without causing a prolonged contraction in GDP. So far, they have had considerable success, but the Bank will be watching closely to maintain this balance into the fall.

Link: https://mailchi.mp/bcrea/canadian-real-gdp-growth-april-2023

For more information, please contact: Gino Pezzani.