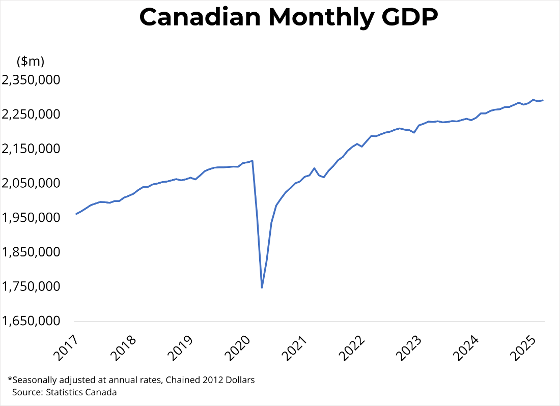

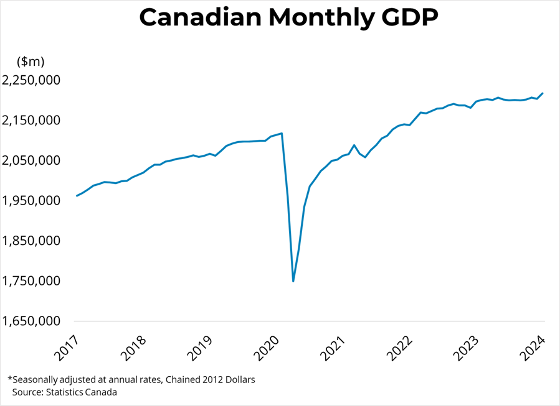

Canadian real GDP decreased by 0.1 per cent in April, following a 0.2 per cent increase in March. Service-producing industries increased by 0.1 per cent, while goods-producing industries fell by 0.6 per cent. While twelve out of twenty major industries expanded from the previous month, decreases in overall growth were driven by broad-based contractions in manufacturing (-1.9 per cent) and wholesale trade (-1.9 per cent), both of which are highly integrated with the United States. Finally, GDP for real estate offices and agents was up 1.3 per cent month-over-month. Preliminary estimates suggest that real GDP decreased by 0.1 per cent in April.

April's GDP data signifies a contraction in the Canadian economy to begin the second quarter. Additionally, this print captures the direct effects of tariffs through sharp declines in motor vehicle manufacturing and wholesale trade, as companies grapple with uncertainty over their potential exports to the United States. Negative growth in April reflects an unwinding of tariff-driven behaviour that boosted exports in the first quarter. While the Bank of Canada projected flat growth in the second quarter, this report—coupled with a projected contraction in May—favours a rate cut during its meeting in July. However, with core inflation remaining near its upper threshold, it remains uncertain whether the Bank will cut or hold its overnight rate. In a highly volatile environment, economists will closely follow next month's CPI and GDP reports for insights into which direction the Bank will take.

https://mailchi.mp/bcrea/canadian-economic-growth-april-2025

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.

-560-wide.jpg)

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani. The Bank of Canada held its overnight policy rate a 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted US trade policy continues to create uncertainty in the global economy and that uncertainty is likely to slow economic growth in coming quarters. On inflation, the Bank cited stronger than expected inflation in April and survey data showing household inflation expectations rising due to tariffs as concerning trends in the evolution of inflationary pressures.

The Bank of Canada held its overnight policy rate a 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted US trade policy continues to create uncertainty in the global economy and that uncertainty is likely to slow economic growth in coming quarters. On inflation, the Bank cited stronger than expected inflation in April and survey data showing household inflation expectations rising due to tariffs as concerning trends in the evolution of inflationary pressures.