To view the March 2024 Mortgage Rate Forecast PDF, click here.

Highlights:

-

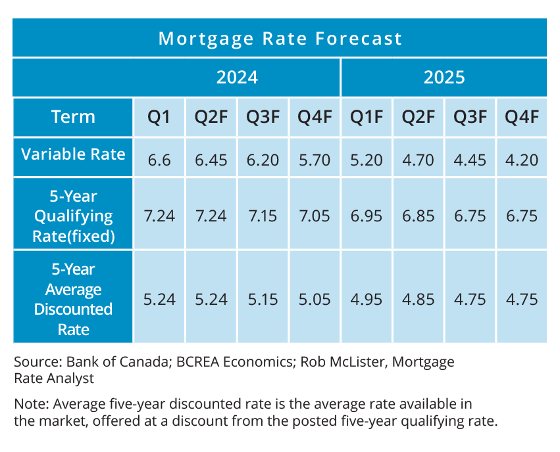

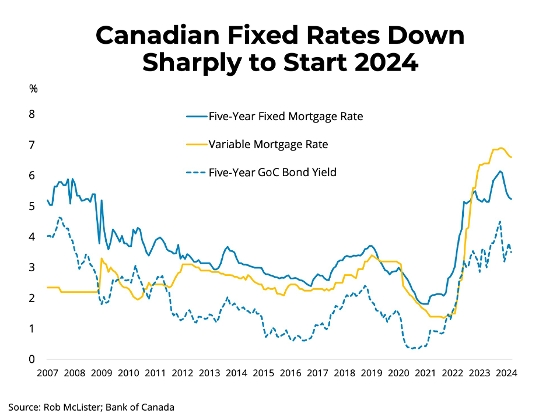

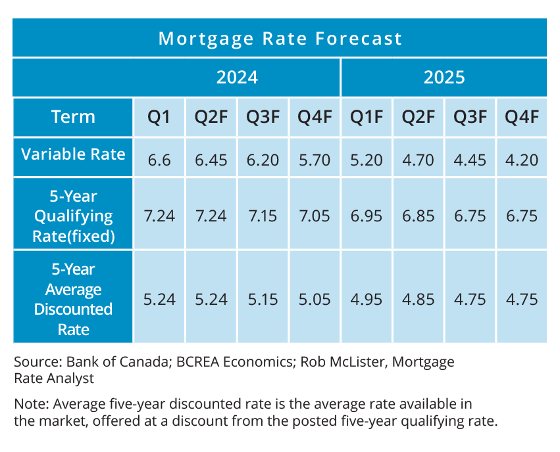

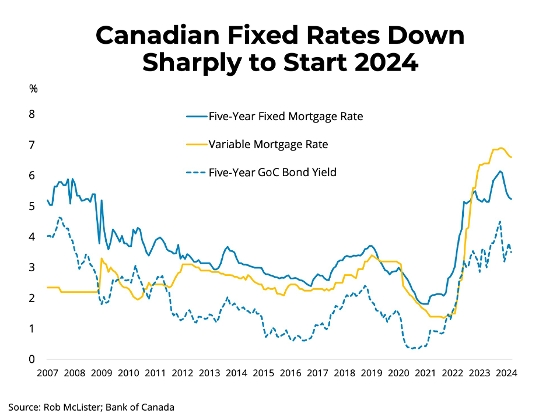

Canadian mortgage rates down sharply to start 2024.

-

The Canadian economy – no recession yet, but growth is very slow.

-

Waiting for the Bank of Canada to cut

.

.

To view the March 2024 Mortgage Rate Forecast PDF, click here.

Highlights:

Canadian mortgage rates down sharply to start 2024.

The Canadian economy – no recession yet, but growth is very slow.

Waiting for the Bank of Canada to cut

.

.

While Metro Vancouver home sellers appeared somewhat hesitant in January, new listings rose 31 per cent year-over-year in February, bringing a significant number of newly listed properties to the market.

Learn more at www.GVRealtors.ca

For more information, please contact: Gino Pezzani.

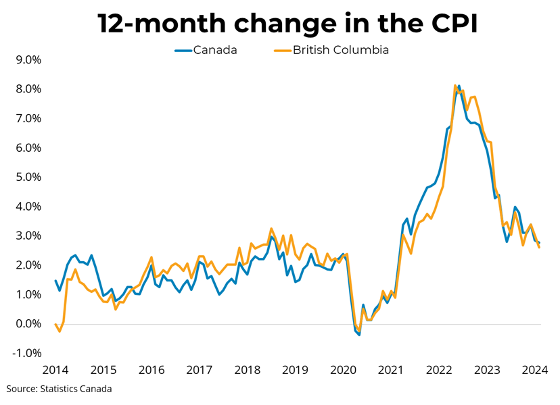

Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.8 per cent on a year-over-year basis in February, down from a 2.9% increase in January. Month-over-month, on a seasonally adjusted basis, CPI rose by 0.1 per cent in February. Excluding energy costs, CPI rose 2.9 per cent year-over-year in February, down from 3.2 per cent in January. Decelerating food costs also contributed to the slowing in the CPI, with prices of food purchased from stores rising by 2.4 per cent in February compared to 3.4 per cent in January. Shelter costs, however, continue to be a major driver of inflation, with mortgage interest costs up 26.3 per cent and rent up 8.2 per cent from the same time last year in February. Excluding shelter, consumer prices rose just 1.3 per cent, year over year. In BC, consumer prices rose 2.6 per cent year-over-year. The Bank of Canada's preferred measures of core inflation, which strip out volatile components, fell to between 3.1 and 3.2 per cent per cent year-over-year in February.

January's CPI report contained a second month unexpectedly good news. Canada's annual change in prices has now remained for two consecutive months within the Bank of Canada's 1 to 3 per cent target range. The last time this occurred was in early 2021. Despite a 4 per cent jump in gas prices, the CPI eased due to slowing price appreciation in other areas of the economy. Food price appreciation has been easing over the past 12 months and is now not far above historical norms, while other CPI components including cellular services have declined in price from last year. The category that remains the most challenging is shelter. Although the appreciation in mortgage costs looks to have peaked, rents in particular so far showing little sign of slowing. Overall, February was another encouraging report, and markets shifted their expectations of rate cuts forward slightly, with the odds of a cut in June increasing. However, the change in CPI will need to continue demonstrating a sustained trend towards 2 per cent over the spring before the Bank of Canada is comfortable cutting rates.

Link: https://mailchi.mp/bcrea/bank-of-canada-interest-rate-announcement-y3ely6wsnh

For more information, please contact: Gino Pezzani.

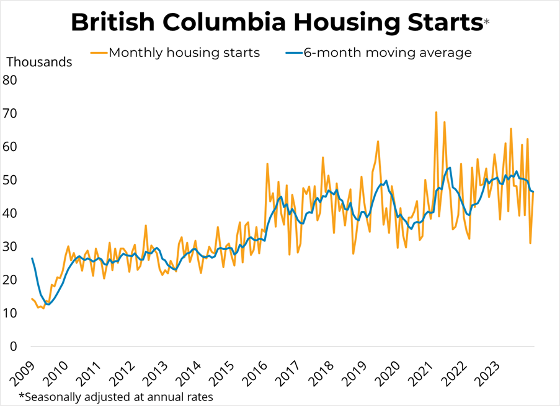

Canadian housing starts rose 14 per cent to 253,468 units in February at a seasonally adjusted annual rate (SAAR). Starts were up 5 per cent from the same month last year. Single-detached housing starts fell 3 per cent from last month to 52,833 units, while multi-family and others rose 19 per cent to 200,638 units (SAAR).

In British Columbia, starts rose 49 per cent from last month to 46,411 units SAAR in all areas of the province. In areas in the province with 10,000 or more residents, single-detached starts fell 4 per cent to 4,585 units while multi-family starts jumped 65 per cent to 39,852 units. Starts in the province were 22 per cent above the levels from February 2023. Compared to the same time last year, starts were down by 28 per cent in Kelowna, 36 per cent in Abbotsford, and 8 per cent in Victoria. In Vancouver, starts were up by 82 per cent and in Nanaimo starts were unchanged from February of 2023.

Link: https://mailchi.mp/bcrea/canadian-housing-starts-february-2024

For more information, please contact: Gino Pezzani.

Canadian retail sales fell 0.3 per cent to $67 billion in January. Excluding volatile items, sales were up 0.4 per cent month-over-month. In volume terms, retail sales rose 0.2 per cent in January. Retail e-commerce trade rose by 3.5 per cent to $3.8 billion in January, amounting to 5.7 per cent of total retail sales.

Sales in BC fell 2.2 per cent in January. BC retail sales were down 2 per cent from the same time last year. In the CMA of Vancouver, retail sales were down 1.6 per cent from the prior month and were unchanged from January of 2022.

Link: https://mailchi.mp/bcrea/canadian-retail-sales-january-2024-march-22-2024

For more information, please contact: Gino Pezzani.

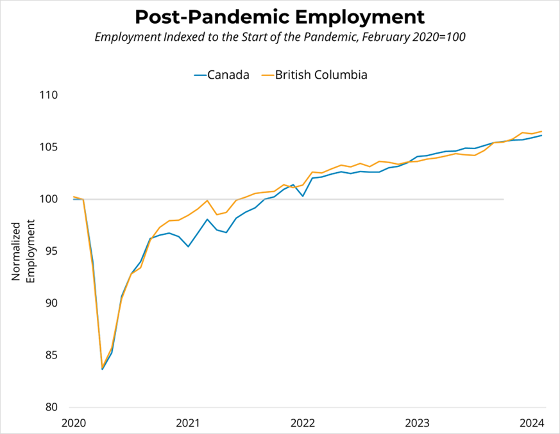

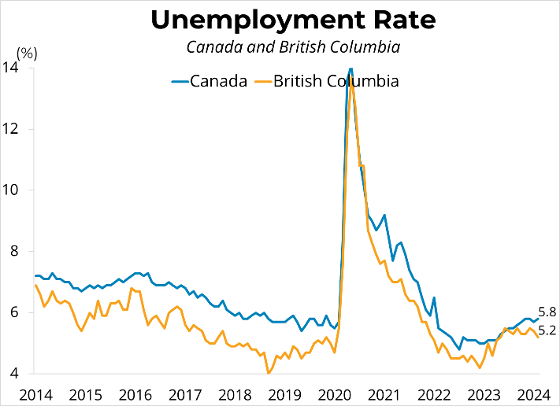

Canadian employment rose by 41,000, or 0.2 per cent, to 20.403 million in February. The unemployment rate rose 0.1 percentage points to 5.8 per cent. Average hourly wages rose 5 per cent year-over-year to $34.82 last month, while total hours worked were up 1.3 per cent from February of last year.

Employment in BC rose 0.2 per cent to 2.841 million, while employment in Metro Vancouver rose 0.2 per cent to 1.615 million in February. The unemployment rate fell 0.2 points in BC to 5.2 per cent while falling in Metro Vancouver by 0.5 points to 5 per cent last month.

Link: https://mailchi.mp/bcrea/canadian-employment-february-2024-march-8th-2024

To view the latest Market Intelligence report PDF, click here.

Summary of Findings

Flipping activity, by any definition, is an insignificant share of overall transactions in BC.

We estimate that the flipping tax will lower sales in BC by 1.7 per cent, but will have minimal impact on home prices.

There is a significant risk that the tax will cause potential sellers to delay listing their homes, leading to lower resale housing supply and tighter market conditions.

The BC Government has announced its intention to implement a flipping tax in British Columbia. Specifically, the government is proposing to add an additional tax to the proceeds of the sale on the sale of a home sold within two years of purchasing.

The BC Government has announced its intention to implement a flipping tax in British Columbia. Specifically, the government is proposing to add an additional tax to the proceeds of the sale on the sale of a home sold within two years of purchasing.

We know that flipping activity can be harmful when markets become overheated, and rapid price appreciation attracts market participants who are purely short-term speculators. It is important to differentiate sellers who are merely trying to profit from short-term market conditions from those who invest their time, labour, and capital to improve the housing stock or provide additional rental units.

In this Market Intelligence, we will look at the potential impact of this policy on the BC housing market and draw out some of its potential consequences.

For more information, please contact: Gino Pezzani.

The Bank of Canada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that economic growth is slow, wage pressures are easing, and the economy overall appears to be in a state of modest excess supply. On inflation, the Bank cited that shelter costs remain the largest contributor to inflation and that it expects headline CPI inflation to remain close to 3 per cent in the first half of this year before gradually falling back to its 2 per cent target.

The Bank of Canada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that economic growth is slow, wage pressures are easing, and the economy overall appears to be in a state of modest excess supply. On inflation, the Bank cited that shelter costs remain the largest contributor to inflation and that it expects headline CPI inflation to remain close to 3 per cent in the first half of this year before gradually falling back to its 2 per cent target.

This morning's decision was much more about what the Bank is signaling for future meetings than the decision itself. All attention will now shift to April 10th, the Bank's next meeting and the first in which a rate cut is a real possibility. Although the economy flirted with recession in 2023, it has so far managed to avoid a lengthy contraction in output. However, economic growth does appear rather anemic and given substantial progress on bringing inflation toward 2 per cent, it is clearly time for the Bank of Canada to begin easing policy. We expect that the Bank will eventually lower its overight rate by 100 basis points this year, with the first rate cut happening in April or June.

Link: https://mailchi.mp/bcrea/bank-of-canada-interest-rate-announcement-82gywlsqrl

For more information, please contact: Gino Pezzani.

To view the full Commercial Leading Indicator PDF, click here.

The BCREA Commercial Leading Indicator (CLI) rose 3.8 points to 149.5 in the fourth quarter of 2023, while the six-month moving average rose to 147.4. Compared to the same quarter in 2022, the index was up by 0.8 per cent.

Fourth Quarter Highlights

The economic activity index rose in Q4. Inflation-adjusted retail trade, wholesale trade, and manufacturing sales rose, pushing the economic component upwards.

Office employment (financial, insurance, real estate, and professional services) fell by 0.6 per cent in the fourth quarter, but manufacturing employment more than offset the decline with a 4.2 per cent increase. On net, the employment component contributed positively to the index.

The financial component of the index rose in the fourth quarter. Rising Real Estate Investment Trust prices pushed the financial component upwards. In addition, falling interest rate spreads, which indicate higher borrowing costs for companies relative to the government, further contributed to the rise in the financial component.

For more information, please contact: Gino Pezzani.

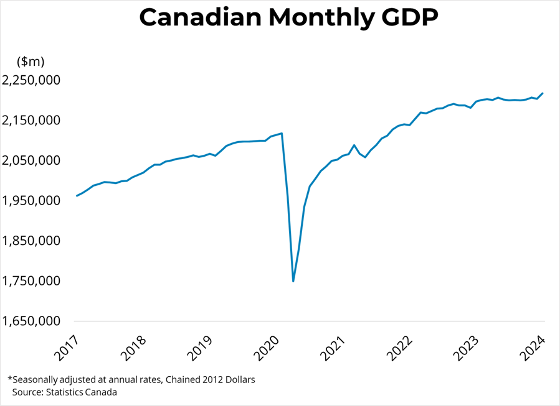

Canadian real GDP was largely unchanged in December, declining by 0.02 per cent, following two months of growth. Goods-producing sectors contracted by 0.2 per cent, while services were essentially unchanged. Construction activity fell 0.6 per cent in December, with residential building declining by 1.6 per cent. Offices of real estate agents and brokers rose 9 per cent, following five consecutive monthly declines amid soft home sales. Preliminary estimates suggest that output in the Canadian economy rose 0.4 per cent in January, helped by the conclusion of strikes in Quebec.

Real GDP rose 0.2 per cent in the fourth quarter, close to 1 per cent on an annualized basis, erasing a 0.1 per cent decline in the third quarter. Improved net exports, driven by the strong US economy and Albertan crude oil, pushed GDP upwards. However, business investment declined for the sixth time over the most recent seven quarters. Household spending rose 0.2 per cent in the fourth quarter, driven by vehicle imports, but strong population growth meant that per capita consumption declined for the third consecutive quarter. At 6.2 per cent, the household savings rate was down slightly from the third quarter, but remains higher than pre-pandemic levels. Housing investment was down for the year, with residential construction down 10.2 per cent and ownership transfer costs down 7.7 per cent. At 1.2 per cent growth, 2023 was the slowest year for real GDP growth since 2016, excluding 2020.

Economic growth in Canada was soft in 2023, and although it flirted with recession it has so far managed to avoid one. The central bank has raised rates by 475 basis points over two years and, as of the most recent data, managed to bring inflation down to 2.9 per cent without causing a major increase in unemployment or a contraction in GDP. The "soft landing" that seemed unlikely two years ago is now visible. However, while aggregate real GDP has not contracted, per capita GDP has contracted for six consecutive quarters as economic growth has failed to keep pace with rapid population growth. Per capita, real GDP is comparable to the level of 2017. Financial markets continue to expect that rate cuts will begin in the late spring and accumulate into the summer. The next rate announcement is on next Wednesday, March 6th.

Link: https://mailchi.mp/bcrea/canadian-economic-growth-real-gdp-q42023

For more information, please contact: Gino Pezzani.

Call or Email me today and let's discuss your next home sale or purchase.