To view the full interactive BCREA Housing Forecast, click here.

To view the full Commercial Leading Indicator PDF, click here.

The BCREA Commercial Leading Indicator (CLI) fell 3.2 points to 145.5 in the first quarter of 2024, while the six-month moving average fell to 146.5. Compared to the same quarter in 2023, the index was down by 1 per cent.

First Quarter Highlights

-

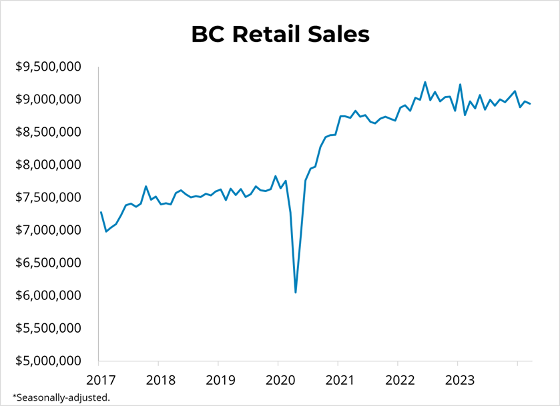

The economic activity index declined in Q1. Inflation-adjusted retail trade (-1.7 per cent), wholesale trade (-2.5 per cent), and manufacturing sales (-5.3 per cent) each fell from the previous quarter, pushing the economic component down.

-

Office employment (financial, insurance, real estate, and professional services) fell by 0.4 per cent in the first quarter, while manufacturing employment declined by 1.3 per cent. The employment component declined from the previous quarter, contributing negatively to the index.

-

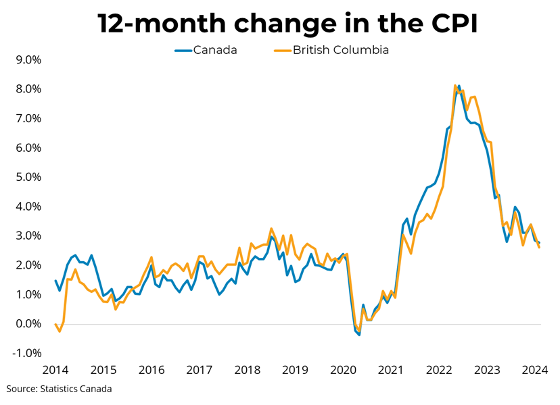

The financial component of the index also declined in the first quarter. Real Estate Investment Trust (REIT) prices declined by 8.5 per cent, pushing the component down. However, interest rate spreads declined for a second consecutive month, indicating lower borrowing costs for companies relative to the government amid expectations of forthcoming rate cuts. This offset some of the effects of declining REIT prices on the CLI, but on net, the financial component was still slightly negative.

For more information, please contact: Gino Pezzani.

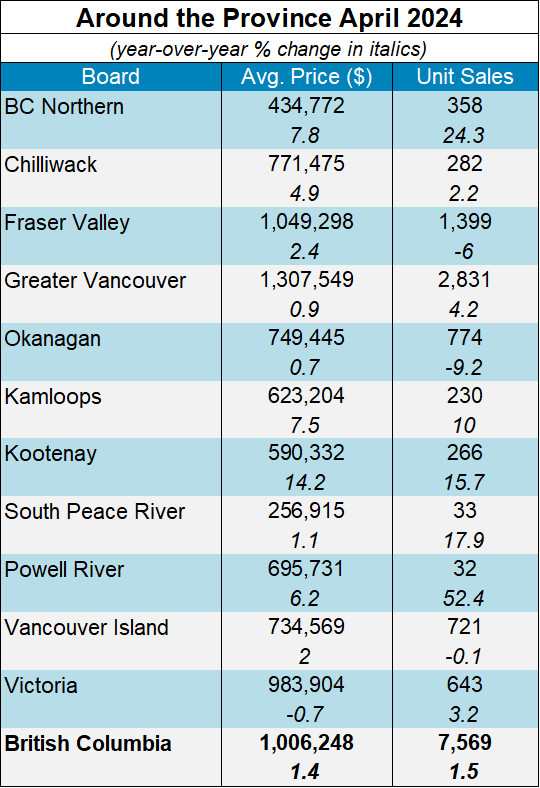

"April was an above-average month for new listings activity, registering the highest pace since 2021," said BCREA Chief Economist Brendon Ogmundson. "Sales are still slightly below normal, which has led to a substantial increase in total inventory, though at a level still far below long-run balance. Ultimately, the market is heading into the summer in a state of relative calm with much more choice for buyers."

"April was an above-average month for new listings activity, registering the highest pace since 2021," said BCREA Chief Economist Brendon Ogmundson. "Sales are still slightly below normal, which has led to a substantial increase in total inventory, though at a level still far below long-run balance. Ultimately, the market is heading into the summer in a state of relative calm with much more choice for buyers." For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.