Posted on

May 14, 2025

by

Gino Pezzani

For the complete news release, including detailed statistics, click here.

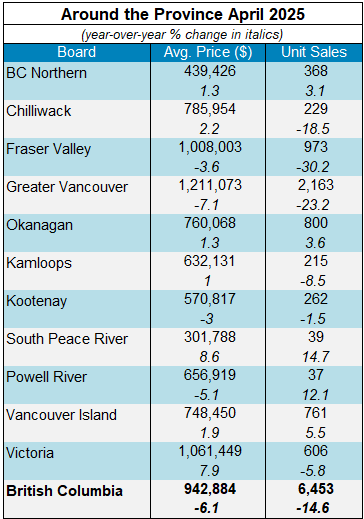

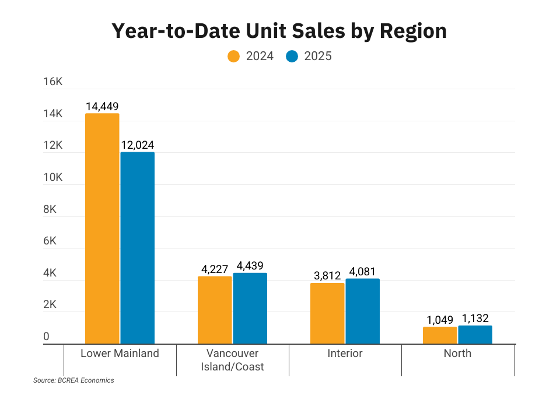

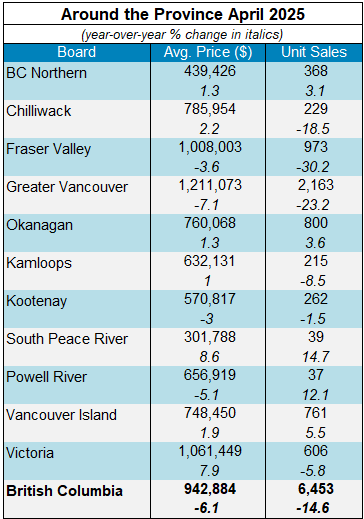

Vancouver, BC – May 2025. The British Columbia Real Estate Association (BCREA) reports that 6,453 residential unit sales were recorded in Multiple Listing Service® (MLS®) Systems in April 2025, down 14.6 per cent from April 2024. The average MLS® residential price in BC in April 2025 was down 6.1 per cent at $942,884 compared to $1,003,638 in April 2024.

The total sales dollar volume was $6.1 billion, a 19.7 per cent decrease from the same time the previous year. BC MLS® unit sales were 27 per cent lower than the ten-year April average.

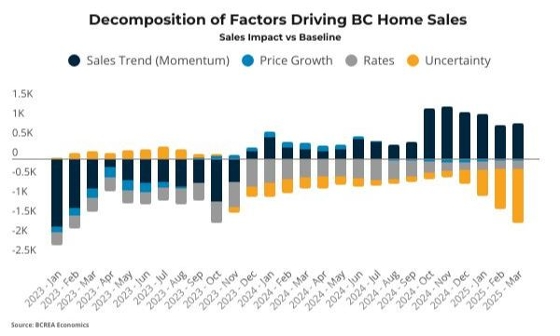

“Regional activity continued to diverge in April with more expensive regions experiencing a larger drop in sales activity,” said BCREA Chief Economist Brendon Ogmundson. “Uncertainty regarding trade and monetary policy has caused trepidation for prospective buyers, largely in the Lower Mainland, prompting overall provincial activity to fall far below historical averages.”

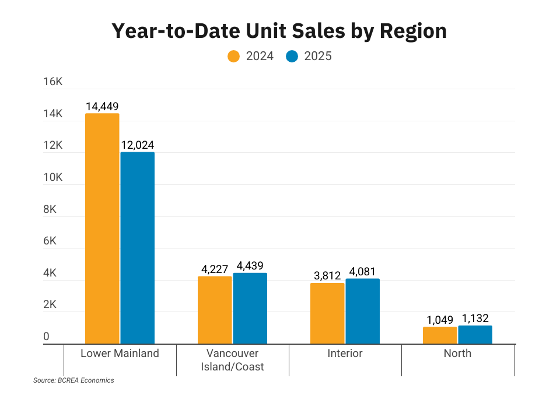

Year-to-date, BC residential sales dollar volume is down 11.7 per cent to $20.7 billion, compared with the same period in 2024. Residential unit sales are down 7.9 per cent year-over-year at 21,676 units, while the average MLS® residential price is also down 4.1 per cent to $953,674.

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.

https://mailchi.mp/bcrea/canadian-retail-sales-march-2025

https://mailchi.mp/bcrea/canadian-retail-sales-march-2025

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.