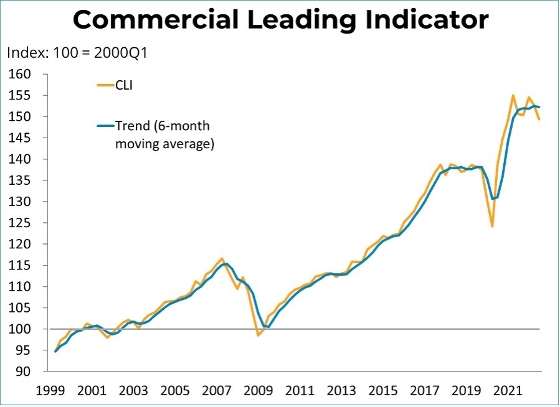

The BCREA Commercial Leading Indicator (CLI) fell to 149 from 153 in the third quarter of 2022 while the six-month moving average retreated from a record high. Compared to the same time in 2021, the index was down by 0.8 per cent.

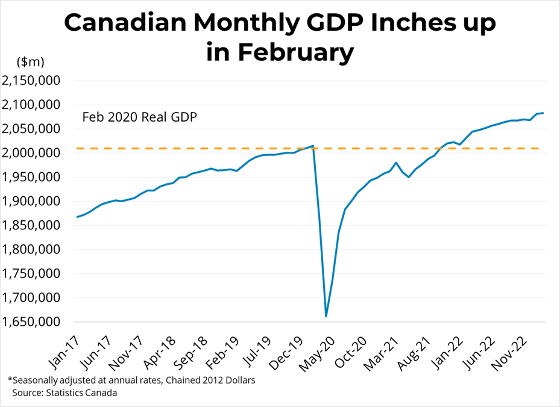

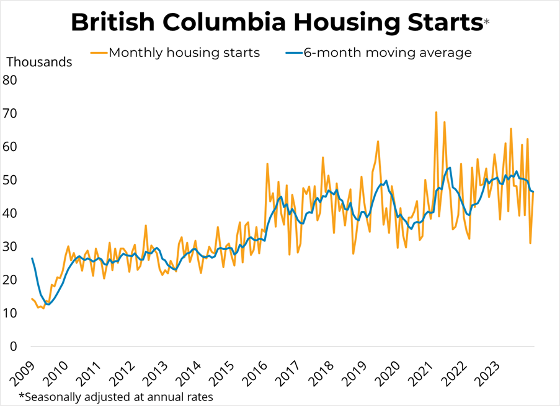

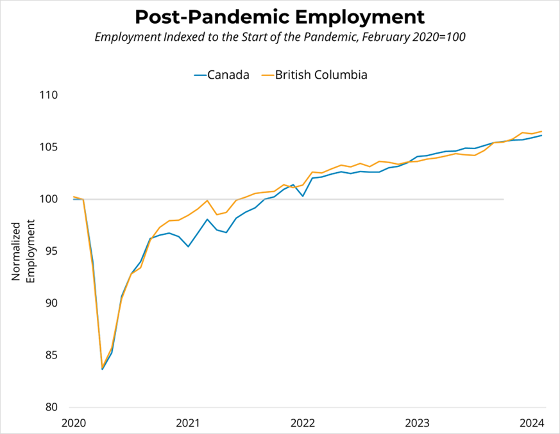

It is important to note that while the Canadian economy has enjoyed a strong recovery, the environment for commercial real estate remains highly abnormal and uncertain. Although the CLI is designed to interpret economic and office employment growth as positive indicators for commercial real estate demand, the recent strong growth of these indicators may not translate as readily into improved conditions in the commercial real estate market relative to the pre-pandemic period.

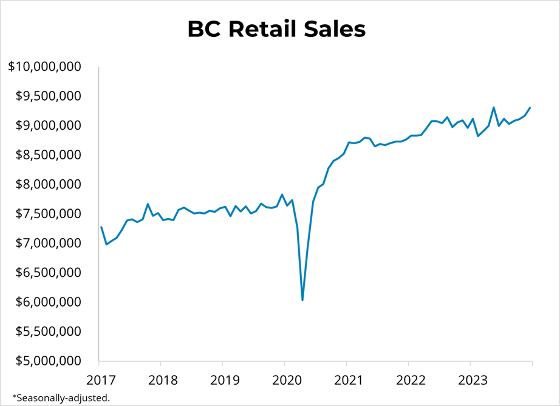

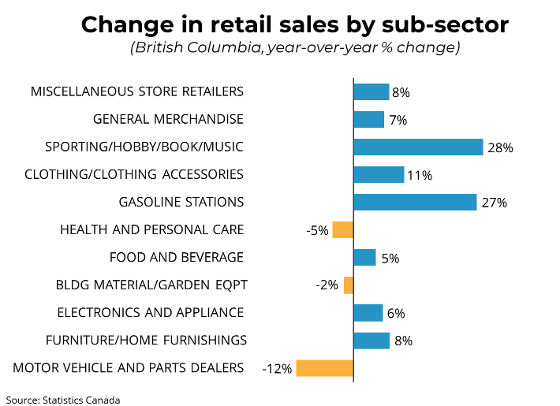

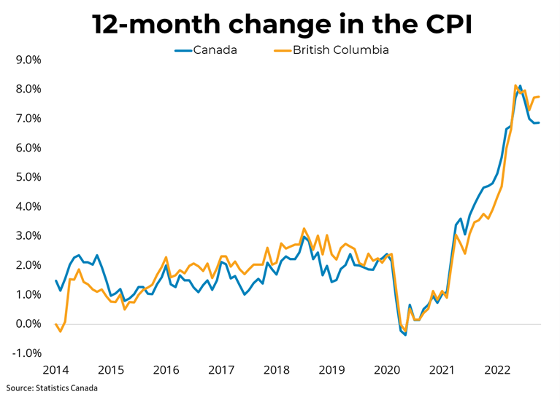

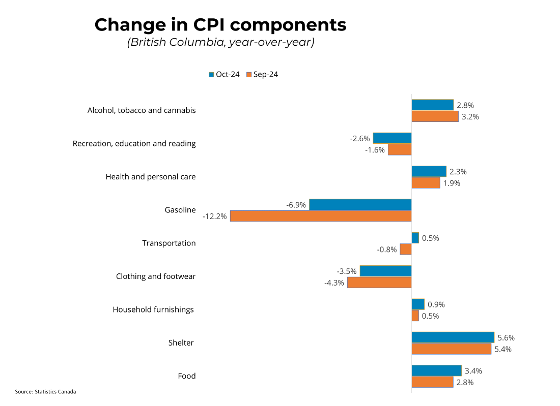

The CLI fell in the third quarter due to deteriorations in all three subcomponents of the index. The economic activity index was driven downwards by inflation-adjusted declines in wholesale trade, retail and manufacturing sales. Rapid appreciation in the consumer price index driven by supply chain obstacles and the war in Ukraine meant that rising nominal values in these economic areas were offset after adjusting for general price growth. The financial component of the index was negative as a result of falling REIT prices. Spreads between corporate and government borrowing costs also rose slightly from the prior quarter, contributing negatively to the financial component. The index’s employment component was also negative, with a rise in office employment (finance, insurance and real estate) insufficient to offset a larger decline in manufacturing employment.

To view the full Commercial Leading Indicator PDF, click here.

For more information, please contact: Gino Pezzani.