Posted on

November 8, 2023

by

Gino Pezzani

Vancouver, B.C. – September, 2023 – Year-over-year declines in sales and dollar volumeshighlighted a qu ieter second quarter (Q2) of 2023 in the Lower Mainland's commercial real estate market.

Vancouver, B.C. – September, 2023 – Year-over-year declines in sales and dollar volumeshighlighted a qu ieter second quarter (Q2) of 2023 in the Lower Mainland's commercial real estate market.

There were 280 commercial real estate sales in the Lower Mainland in Q2 2023, a 56.5 per cent decrease from the 644 sales recorded in Q2 2022, according to data from Commercial Edge, a commercial real estate system operated by the Real Estate Board of Greater Vancouver (REBGV).

The total dollar value of commercial real estate sales in the Lower Mainland was $1.763 billion in Q2 2023, a 54 per cent decrease from $3.831 billion in Q2 2022.

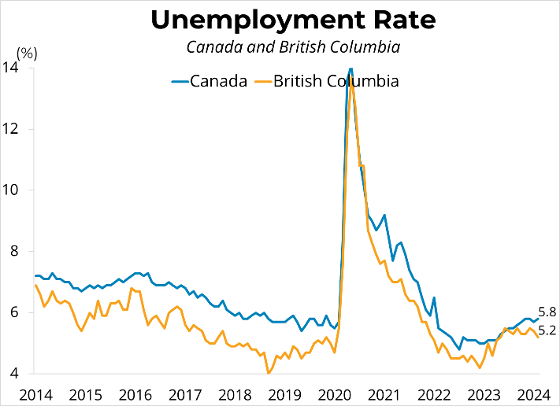

"Real estate transactions across the Lower Mainland have been affected by some of the highest borrowing costs we've seen in over 10 years," Andrew Lis, REBGV’s Director of Economics and Data Analytics, said. "With the landscape for monetary policy looking set where it is for at least the near-term, it's likely we'll see the commercial real estate market continue along this trajectory for the rest of 2023."

Q2 2023 activity by category

Land: There were 83 commercial land sales in Q2 2023, which is a 62.6 per cent decrease from the 222 land sales in Q2 2022. The dollar value of land sales was $789 million in Q2 2023, a 57.6 per cent decrease from $1.863 billion in Q2 2022.

Office and Retail: There were 112 office and retail sales in the Lower Mainland in Q2 2023, which is down 51.3 per cent from the 230 sales in Q2 2022. The dollar value of office and retail sales was $281 million in Q2 2023, a 63.4 per cent decrease from $767 million in Q2 2022.

Industrial: There were 66 industrial land sales in the Lower Mainland in Q2 2023, which is a 59 per cent decrease from the 161 sales in Q2 2022. The dollar value of industrial sales was $428 million in Q2 2023, a 32.4 per cent decrease from $633 million in Q2 2022.

Multi-Family: There were 19 multi-family land sales in the Lower Mainland in Q2 2023, which is down 38.7 per cent from 31 sales in Q2 2022. The dollar value of multi-family sales was $266 million in Q2 2023, a 53.2 per cent decrease from $568 million in Q2 2022.

For more information, please contact: Gino Pezzani.