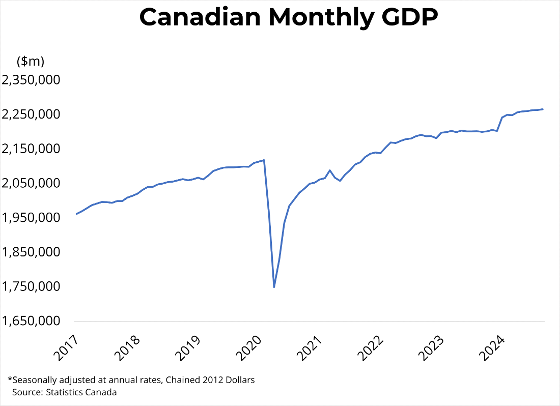

Canadian real GDP rose by 0.1 per cent in September, after being largely unchanged in August. Goods-producing sectors fell 0.3 per cent, while service-producing industries were up 0.2 per cent. Mining, quarrying and the oil and gas extraction sector (-1.4 per cent) and manufacturing (-0.3 per cent) were the main drivers of downward pressure on growth, and were offset by gains in retail trade (+1 per cent), wholesale trade (+0.9 per cent), and construction (+0.4 per cent). Finally, output for the offices of real-estate agents and brokers grew by 3.0 per cent month-over-month. Preliminary estimates suggest that real GDP by industry also increased by 0.1 per cent in October.

Real GDP growth in the third quarter of 2024 registered at 1.0 per cent at an annualized rate from the prior quarter. Household spending grew by 0.9 per cent, leading to a 0.2 per cent increase in per capita household expenditures. Growth was also driven by broad-based government spending (+1.1 per cent). Conversely, business investment in machinery fell by 7.8 per cent in the third quarter, strongly attributed to lower spending on aircraft and transportation equipment. Housing investment rose by 0.8 per cent, largely due to higher ownership transfer costs (+4.9 per cent) that arise from resales. However, renovation spending and new construction declined by 0.4 per cent and 0.1 per cent, respectively. Despite higher household consumption, household savings rates reached a 3-year peak at 7.1 per cent, as disposable income grew at nearly double the rate of spending (in nominal terms). On a per capita basis, GDP was down 0.4 per cent in Q3 and marked a sixth consecutive quarterly decline.

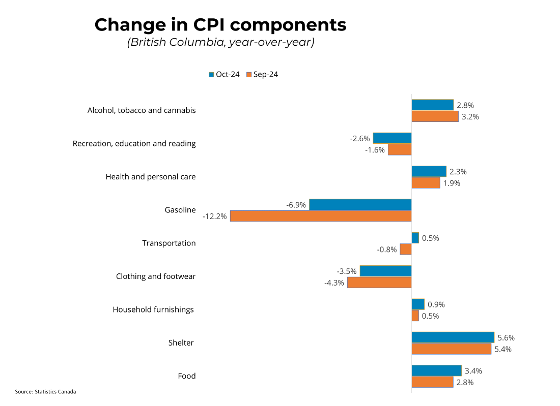

Canada saw modest GDP growth in the third quarter, which fell short of the Bank of Canada's most recent quarterly projection of 1.5 per cent growth. The main discrepancies between this report and the Bank's projection are found in lower-than-anticipated business investment and household spending, signalling reluctance among firms and consumers due to more difficult borrowing conditions. In addition, Canadian GDP per capita continues to struggle amidst rapid population growth. This comes in the context of inflation moderating towards the midpoint of its target range, with price appreciation being largely driven by high shelter costs. The labour market remains at cooler levels, with unemployment steadying at around 6.5 per cent. Considering weaker than expected growth, a second consecutive 50-point cut from the Bank seems more likely as they hope to ignite expenditure moving into 2025.

For more information regarding British Columbia's GDP growth, please visit our Nowcast for an estimate of economic activity throughout the province:

For more information, please contact: Gino

Pezzani.https://infogram.com/1p2xk20pe2d70ea0v5l77vq3r2brvzx6565?live