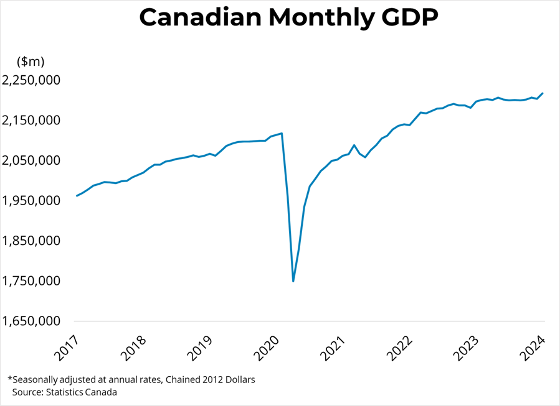

Canadian GDP edged up by 0.1 per cent in August, following similar increases in June and July. Growth in services-producing industries (+0.3 per cent) offset declines in goods-producing industries (-0.3 per cent) as GDP grew in 14 of 20 subsectors. Canadian real GDP is roughly 2.6 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy grew again by 0.1 per cent in September. GDP from the offices of real estate agents and brokers dropped 2.1 per cent in August, the sixth consecutive decline, as rising interest rates continued to restrain home sales.

GDP growth in recent months, though still positive, is showing signs of slowing. We are currently tracking Q3 real GDP growth at just 1.5 per cent, or about half the rate realized over the first half of 2022. That slowdown will likely continue as the Bank continues its tightening cycle, particularly in interest rate sensitive sectors like housing. The Bank raised its overnight rate in October to 3.75 per cent and the final destination for the overnight rate may be around 4 per cent or above. However, with the rate now higher than the bank's estimate of the neutral rate, meaning monetary policy is no longer stimulative, increases in the overnight rate are expected to slow in subsequent announcements.

Link: https://mailchi.mp/bcrea/canadian-economic-growth-real-gdp-october-2022

For more information, please contact: Gino Pezzani.