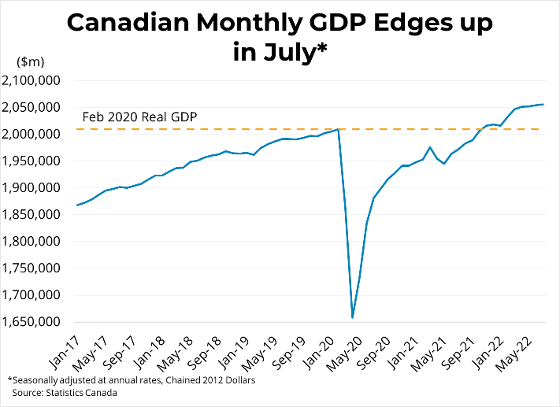

Canadian GDP edged up by 0.1 per cent in July, following a similar increase in June. Growth in goods-producing industries (+0.5 per cent) offset declines in service-producing industries (-0.1 per cent) as GDP grew in 11 of 20 subsectors. Canadian real GDP is roughly 2.3 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy was essentially flat in August. GDP from the offices of real estate agents and brokers dropped 3.4% in July, the fifth consecutive decline, as rising interest rates continued to restrain home sales.

GDP growth in recent months, though still positive, is showing signs of slowing. That slowdown will likely continue as the Bank continues its tightening cycle, particularly in interest rate sensitive sectors like housing. As expected, the Bank raised its overnight rate in September to 3.25 per cent and the final destination for the overnight rate may be closer to 4 per cent. However, with the rate now above the bank's estimate of the neutral rate, meaning monetary policy is no longer stimulative, increases in the overnight rate are expected to slow in subsequent announcements.

Link: https://mailchi.mp/bcrea/canadian-economic-growth-real-gdp-july-2022

For more information, please contact: Gino Pezzani.

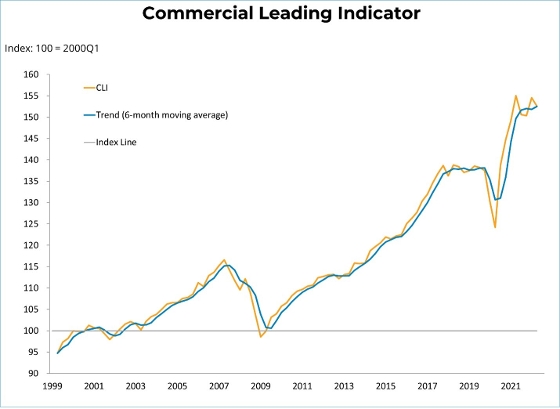

The BCREA Commercial Leading Indicator (CLI) fell to 153 from 155 in the second quarter of 2022, but the six-month moving average hit a record high. Compared to the same time in 2021, the index was down by 1.6 per cent.

The BCREA Commercial Leading Indicator (CLI) fell to 153 from 155 in the second quarter of 2022, but the six-month moving average hit a record high. Compared to the same time in 2021, the index was down by 1.6 per cent.

As was widely expected, the Bank of Canada raised its overnight policy rate by 0.75 basis points, bringing it to 3.25 per cent. In the statement accompanying the decision, the Bank noted that while CPI inflation eased somewhat in July, that easing was due only to a fall in gasoline prices and more broad-based measures of price growth like core inflation moved slightly higher. The Bank continues to see excess demand in the Canadian economy, but does anticipate a moderation in the second half of the year. Ultimately, the Bank sees a need for the policy rate to rise further and will be assessing how much higher interest rates need to go to bring inflation back to its 2 per cent target.

As was widely expected, the Bank of Canada raised its overnight policy rate by 0.75 basis points, bringing it to 3.25 per cent. In the statement accompanying the decision, the Bank noted that while CPI inflation eased somewhat in July, that easing was due only to a fall in gasoline prices and more broad-based measures of price growth like core inflation moved slightly higher. The Bank continues to see excess demand in the Canadian economy, but does anticipate a moderation in the second half of the year. Ultimately, the Bank sees a need for the policy rate to rise further and will be assessing how much higher interest rates need to go to bring inflation back to its 2 per cent target.