Posted on

September 17, 2023

by

Gino Pezzani

How Auckland’s housing policy success can inspire BC’s new Homes for People housing action plan

Vancouver, BC – September, 2023. As British Columbia continues to grapple with an ongoing housing crisis, a new economic report reveals how the province’s Homes for People housing plan can expand housing supply and improve housing affordability by following the blueprint of New Zealand’s Auckland Unitary Plan (AUP).

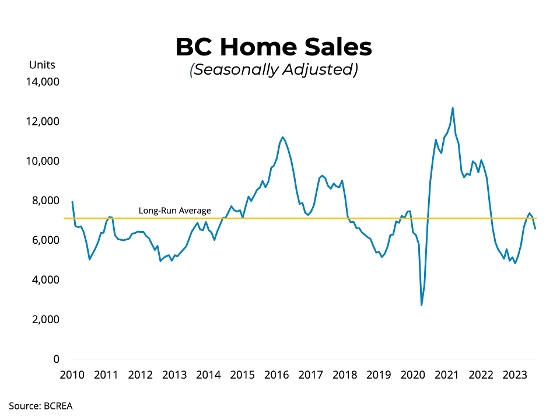

According to the latest Market Intelligence report from the BC Real Estate Association (BCREA), following the aggressive housing liberalization and upzoning policy in Auckland would eventually improve affordability in BC by slowing home price growth and allowing incomes to catch up. Additionally, expanding the housing stock would lead to healthier resale inventories and balance markets while shifting the distribution of sales toward principal owners by reducing speculative activity.

Summary Findings:

New evidence from Auckland shows that policy change can achieve a 50 per cent increase in housing permits in less than a decade and successfully soften housing costs.

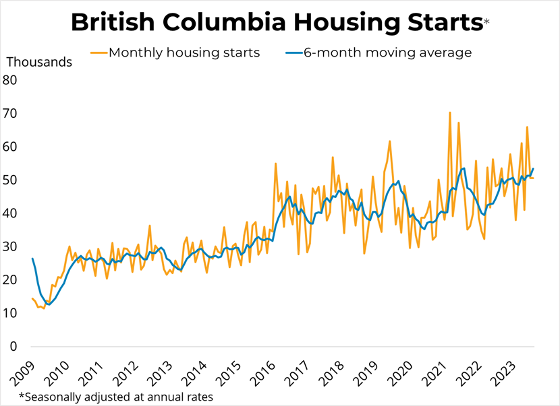

BC is currently experiencing historically low per capita housing starts, and a 50 per cent boost in starts by the end of this decade would bring activity back to the level of the early 90s, but still far below the levels of the 70s.

BCREA’s Real Estate Policy Analysis Model (REPAM) predicts that such a boom in housing starts would increase home completions by 37 per cent per quarter relative to a status quo baseline by Q4 of 2030, while the total housing stock would be 2 per cent higher.

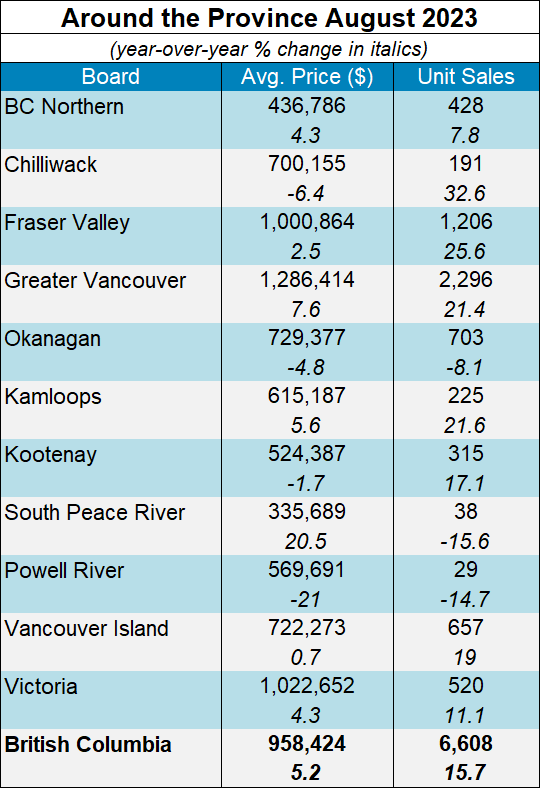

The model predicts that the increase in housing supply would pull average prices down by 4 per cent relative to a status quo baseline by Q4 of 2030, and slow long-run price growth, modestly improving affordability.

Read the Report

“While it is promising to see that steps can be taken, affordability in BC deteriorated due to chronic underbuilding for decades, and will not quickly be remedied,” says BCREA Chief Economist Brendon Ogmundson. “Still, if policymakers can increase housing supply quickly and extensively through a combination of measures, there is hope that affordability can improve in the province again.”

“These results are encouraging, but the scale and immediacy of the problem are considerable,” Ogmundson adds.

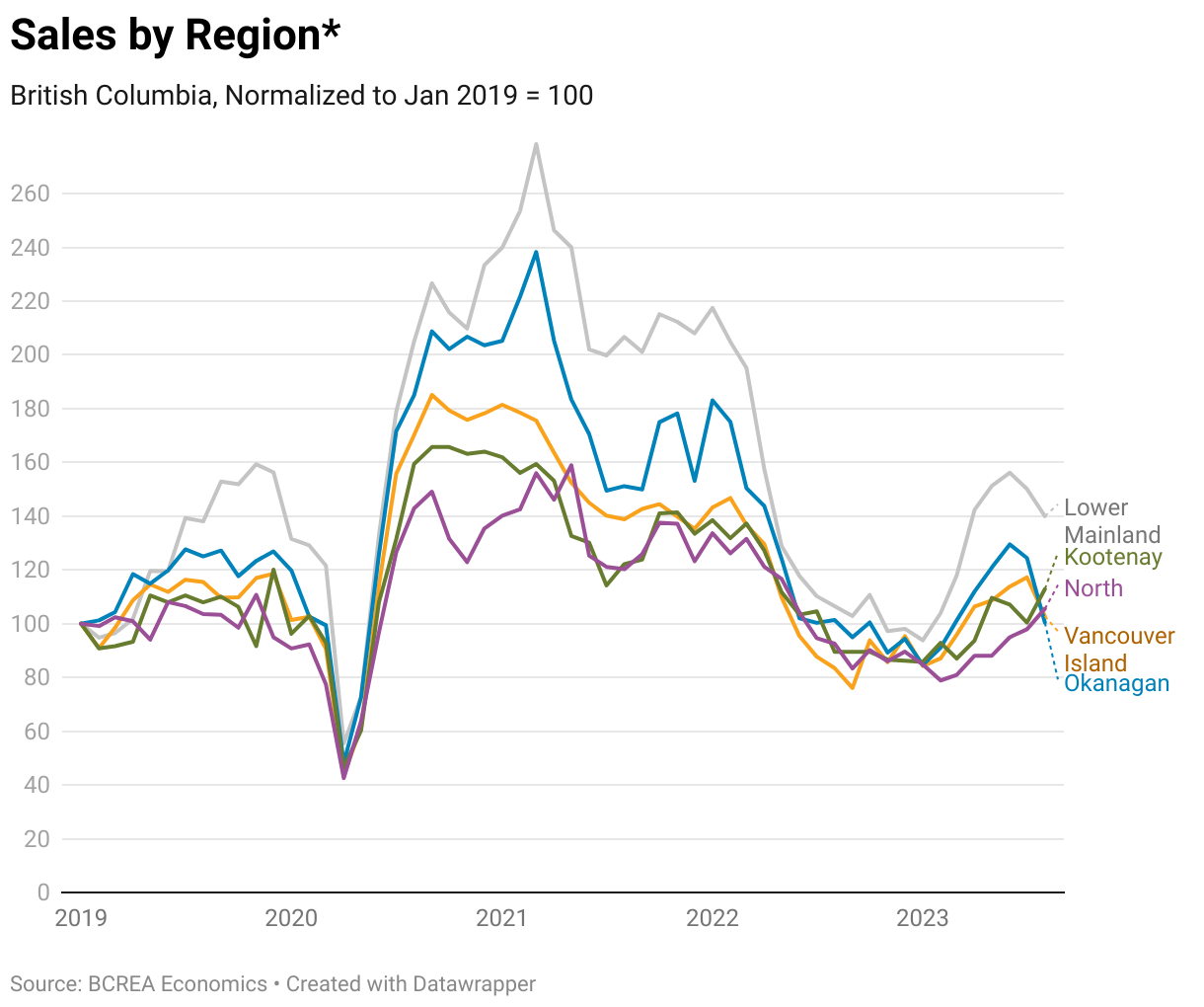

Since the start of the COVID-19 pandemic, average home prices in BC have risen nearly 40 per cent, with new rental costs up by a similar amount. Listings on the MLS® system have plummeted by nearly a quarter. However, the report shows that BC’s forthcoming housing plan has the potential to enable a building boom similar in magnitude to the AUP through a policy of re-zoning and incentives for new home construction. By bringing per capita starts back to a more historically normal level, the affordability ratio can gradually be bent in the right direction.

For more information, please contact: Gino Pezzani.

The link: 2023-09-25-market-intelligence.pdf (bcrea.bc.ca)

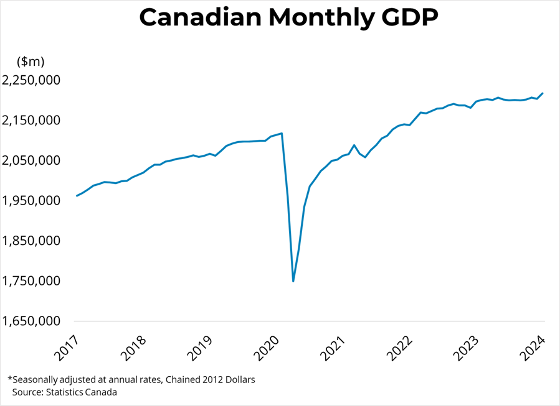

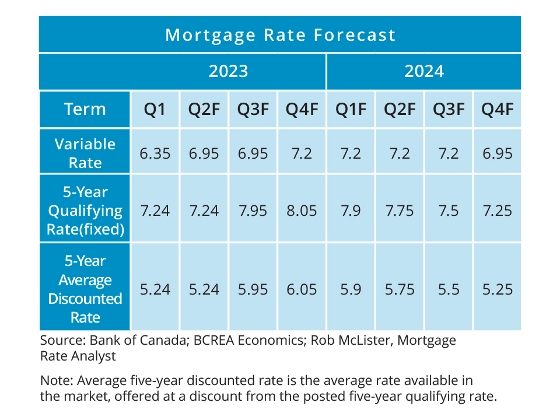

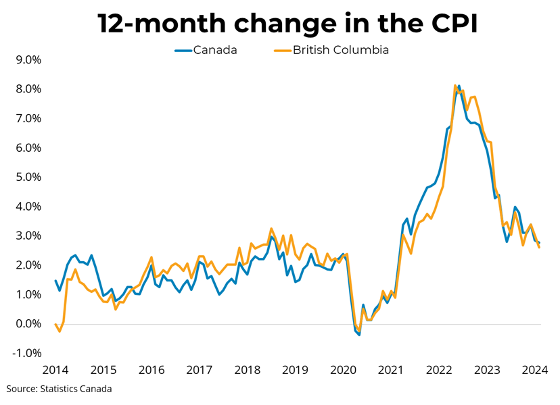

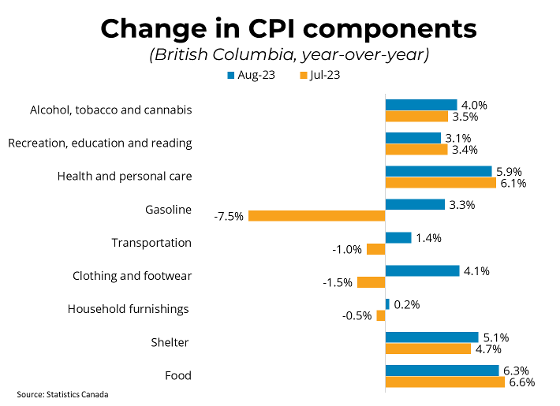

The Bank of Canada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that the Canadian economy has entered a period of weaker growth, with slowing household spending and housing activity. On inflation, the Bank cited that recent data indicates inflationary pressures are broad-based and rising gas prices may cause a near term increase in CPI inflation. Meanwhile, core measures of inflation continue to trend near 3.5 per cent with little recent downward momentum.

The Bank of Canada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that the Canadian economy has entered a period of weaker growth, with slowing household spending and housing activity. On inflation, the Bank cited that recent data indicates inflationary pressures are broad-based and rising gas prices may cause a near term increase in CPI inflation. Meanwhile, core measures of inflation continue to trend near 3.5 per cent with little recent downward momentum.