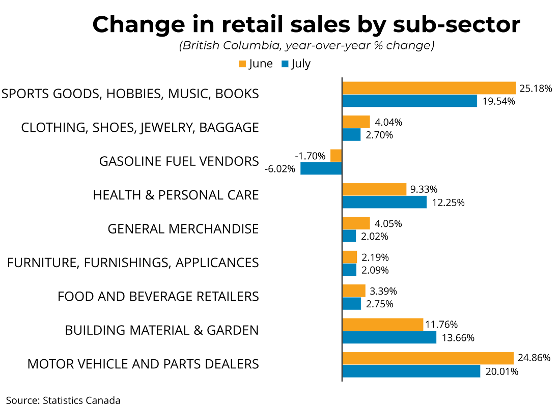

Canadian retail sales decreased by 0.8 per cent to $69.6 billion in July compared to the previous month. Compared to the same time last year, retail sales were up by 4.0 per cent. Furthermore, core retail sales, which exclude gasoline and automobile items, were down 1.2 per cent month-over-month. In volume terms, adjusted for rising prices, retail sales decreased by 0.8 per cent in July.

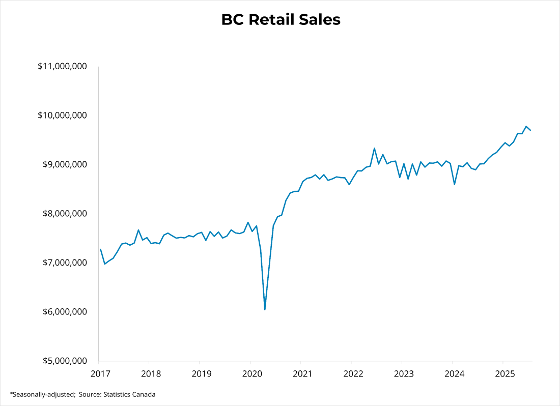

Retail sales in British Columbia were down 0.8 per cent in July from the previous month and rose by 7.6 per cent compared to the same time last year. In the CMA of Vancouver, retail sales were down 1.6 per cent from the prior month and were 8.9 per cent above the level of July 2024.

July's report contributes to a broader trend of sizeable monthly volatility in Canadian retail sales, with retail activity decreasing in eight out of nine major subsectors compared to June. Moreover, weakness in core retail sales may be indicative of a weakening Canadian labour market and economy as households adapt to a dimmer outlook for the year's final quarter. After cutting the overnight rate earlier this week, the Bank of Canada will monitor how core inflation and growth evolve before forming a policy stance for its meeting in October.

https://mailchi.mp/bcrea/canadian-retail-sales-july-2025

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.

For more information, please contact: Gino Pezzani.

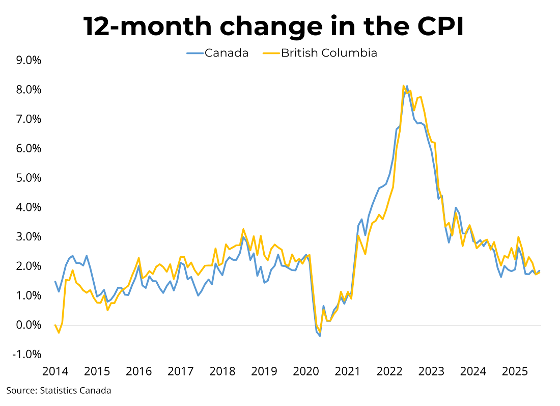

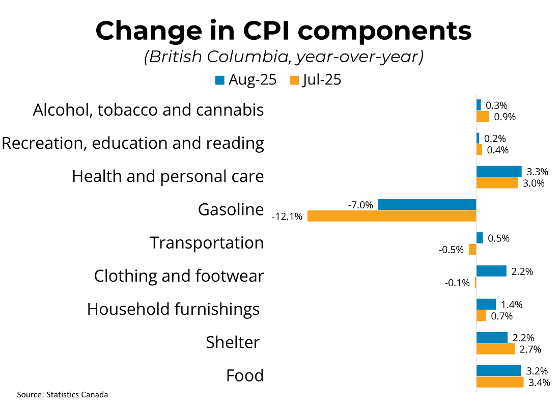

The Bank of Canada lowered its overnight policy rate to 2.5 per cent this morning. In its statement, the Bank noted that US tariffs sharply impacted Canadian export levels while also hindering business investment. In spite of resilient consumer spending, GDP declined by about 1.5% in the second quarter, aligning with the Bank's most recent projection. In addition, the Canadian labour market has cooled further through the summer, with the national unemployment rate reaching 7.1 per cent, its highest level since May 2016, excluding the pandemic. Regarding inflation, the Bank noted that the upward pressure on month-over-month core inflation growth is dissipating, which, coupled with the de-escalatory behaviour from our government, reduces the overall inflationary risks associated with trade policy moving forward.

The Bank of Canada lowered its overnight policy rate to 2.5 per cent this morning. In its statement, the Bank noted that US tariffs sharply impacted Canadian export levels while also hindering business investment. In spite of resilient consumer spending, GDP declined by about 1.5% in the second quarter, aligning with the Bank's most recent projection. In addition, the Canadian labour market has cooled further through the summer, with the national unemployment rate reaching 7.1 per cent, its highest level since May 2016, excluding the pandemic. Regarding inflation, the Bank noted that the upward pressure on month-over-month core inflation growth is dissipating, which, coupled with the de-escalatory behaviour from our government, reduces the overall inflationary risks associated with trade policy moving forward.