Posted on

March 5, 2026

by

Gino Pezzani

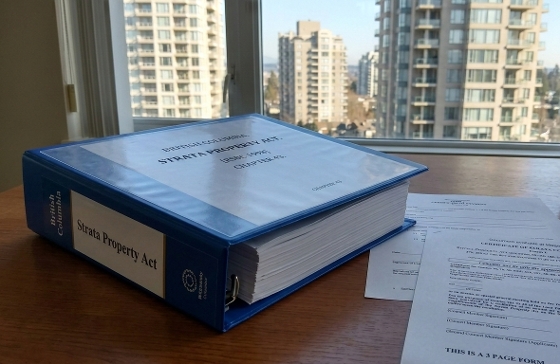

Vancouver, BC – February 9, 2026. The Association of Interior REALTORS® (AOIR) and the BC Real Estate Association (BCREA) are asking the BC Government for a full legislative review of the Strata Property Act and increased education for strata councils.

As demand for smaller, more affordable housing grows, the prevalence of strata-titled properties has increased significantly. Current estimates put the number of people living in strata housing across British Columbia at over 1.5 million. This means that, with ever greater frequency, real estate deals require parties to a transaction to obtain and understand a number of important strata-related documents.

Despite the increased prevalence of these documents in transactions, the legislation that governs stratas and the rules around strata document delivery remain unchanged and are unable to keep up with the evolving needs of consumers. Issues with obtaining these documents – including disputes on cost, long wait times, and incomplete packages – have become increasingly normal.

“Meaningful reform must begin with a full review of the Strata Property Act,” said Seth Scott, AOIR Director of Government Relations and Communications. “REALTORS® work with strata corporations and documents every day, and modernizing the legislation is essential to ensuring buyers are able to continue having accurate, reliable, and accessible information.”

In a joint letter to the BC Ministry of Housing and Municipal Affairs, AOIR and BCREA delivered six policy recommendations regarding the Strata Property Act, ranging from Form B costs, delivery timelines, and mandatory strata council education. The organizations also highlighted the operational challenges associated with obtaining strata documents prior to listing, emphasizing the need for change.

The Strata Property Act has not undergone a comprehensive legislative review since its inception over a quarter century ago. As a result, REALTORS®, strata management, and consumers are working with outdated requirements created before the widespread use of digital technology, which do not reflect the modern realities of strata governance, record keeping, and buyer expectations.

“The legislation requires significant updates to ensure that document delivery timelines are manageable, and that rush fees are fair and transparent across the province,” added Scott.

As part of the larger call to government, BCREA has created a proposal entitled, Mandatory Strata Training Program: Driving Excellence in Strata Property Management. Modeled on Ontario’s Director Training but tailored to BC, the proposal aims to create a training system to empower strata council members to make informed financial decisions, maintain buildings proactively, and resolve disputes with fairness and consistency.

By introducing mandatory training and raising the standard of council education, this initiative could lead to safer, better-maintained properties, fewer surprise special levies, and a more harmonious living environment.

“Civil Rights Tribunal decisions in BC repeatedly surface preventable governance failures with uneven bylaw enforcement, deferred maintenance, and misuse of insurance,” said Jasroop Gosal, BCREA Government Relations Manager. “It’s time to fix this with mandatory, no‑cost, multilingual strata council training that sets clear competencies and publicly registers certified council members. Backed by continuing education and government oversight, this evidence‑based approach will stabilize reserve planning and rebuild trust in strata governance.”

AOIR and BCREA are urging the Ministry of Housing and Municipal Affairs to conduct a full legislative review of the Strata Property Act before considering or proceeding with additional strata regulations.

Learn More:

To read AOIR and BCREA’s full letter to the BC Government, click here.

To read BCREA’s mandatory strata training proposal, click here.